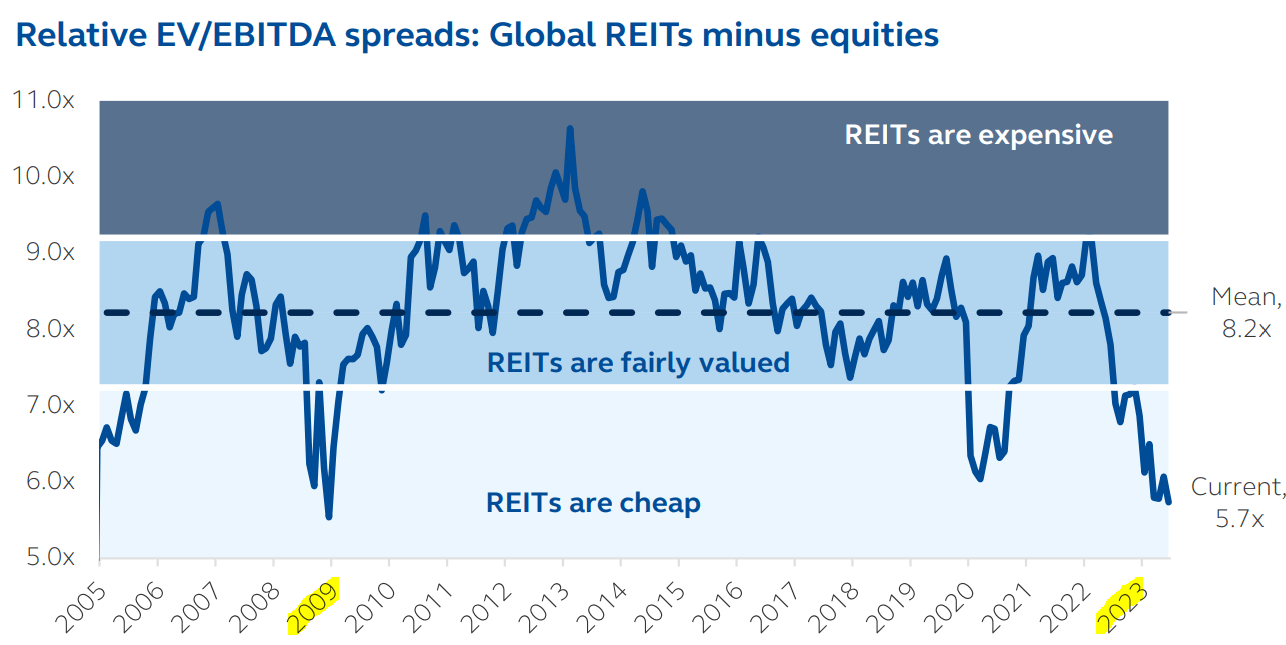

REITs (VNQ) are today priced at their lowest valuations since the great financial crisis:

Principal Asset Management

And historically, it has always been a good idea to buy REITs when they were so severely discounted.

I don’t think that this time will be any different. When you get to buy high-quality real estate at pennies on the dollar, it is hard to mess it up over the long run.

But just because REITs are opportunistic does not mean that all of them are worth buying. This is a vast and versatile sector with over 1,000 companies worldwide, and just because two companies share the “REIT” acronym does not mean that they have anything in common.

I am very bullish on REITs, but I am still objective enough to recognize that many of them will likely disappoint over time.

Here are three REITs that I would avoid today:

Boardwalk is a Canadian REIT that owns mostly apartment communities.

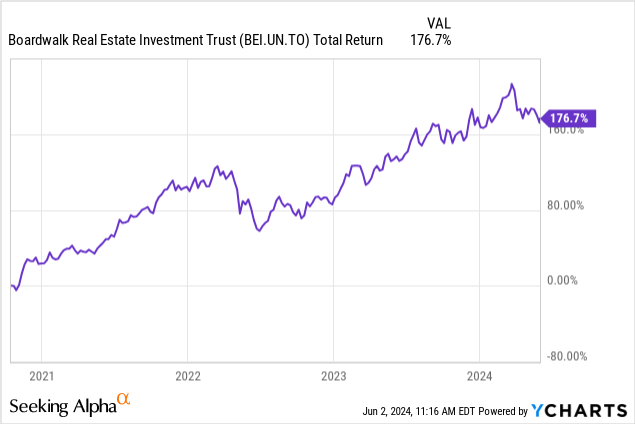

It was once our largest Canadian REIT investment, and we even predicted that it would appreciate by over 100% back in October of 2020.

High Yield Landlord

Boardwalk REIT

That’s how cheap the REIT used to be!

But four years later, this upside has now been realized and the REIT has become expensive relative to its peers.

Historically, Boardwalk used to trade at a discount relative to most other apartment REITs because it owns mostly older Class B properties in riskier energy-sensitive markets.

But right now, its market is doing particularly well, and it has caused it to massively outperform its close peers, closing the valuation gap.

For once, it is the opposite. It is Boardwalk that’s priced at a premium valuation. It currently trades at a ~5% implied cap rate, even as blue-chip apartment REITs like Camden Property Trust (CPT) trade at a 6.5% implied cap rate in the US. That’s despite Camden enjoying:

- Much larger scale

- Having an A- investment grade rating

- A better long-term track record

- Superior development capabilities

- Safer market exposure

Costar

My capital is limited and for this reason, I sold my position in Boardwalk and reinvested the proceeds into some of its cheaper close peers.

I wouldn’t mind owning it again someday in the future. I have met their management and really like their approach. Its valuation just isn’t that attractive compared to other apartment REITs in today’s market.

Universal Health Realty Income Trust (UHT)

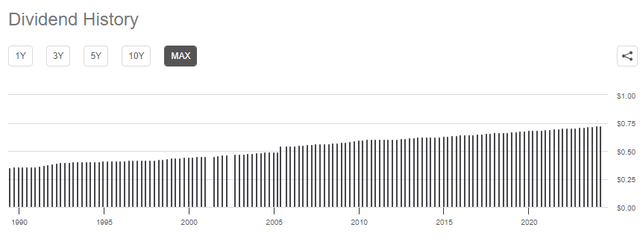

Many investors are buying Universal Health Realty because of one key reason:

It is today priced at a 7.7% dividend yield, and that’s despite having managed to grow its dividend for ~35 years in a row.

That’s one of the longest dividend growth streak of any REIT, and it has rarely traded at such a high yield, so why not buy it right now?

Seeking Alpha

Here are two main reasons:

1) I predict that it will cut its dividend. Right now, its payout ratio is high at ~90%, which leaves very little room for error right as it is facing declining cash flow from tenant issues, rising vacancy, growing capex needs, and surging interest expense. I know that the REIT raised its dividend in December 2023 and some people like to think that the “safest dividend is the one that has just been raised” but note that the dividend hike was just 0.7%. Its purpose was just to keep the streak going. W. P. Carey (WPC) did the same thing shortly before cutting its dividend, and it really alienated its shareholders, who then took the cut as a betrayal from the management. I fear that the same could happen here in the near term.

2) An even bigger problem is that the company’s valuation makes little sense to me. It is actually priced at a premium relative to its close peer, Healthcare Realty (HR), and that’s despite: (1) owning weaker assets, (2) having a worse balance sheet, (3) being externally managed, which leads to conflicts of interest, (4) and having worse growth prospects.

We used to own UHT, but we got out in late 2022 at $47.76.

I am glad we did, as it today trades at a $10 lower share price.

Getty Realty (GTY)

Getty Realty is one of the most popular net lease REITs and I think that it is largely because of two reasons:

1) It owns mostly gas station / convenience store net lease properties, which are perceived to be recession-resistant. Investors also seem to like these particular properties because they have a sense of familiarity with them, as they regularly visit such properties themselves.

2) It offers a ~100 basis point higher dividend yield than its net lease peers, Realty Income (O), Agree Realty (ADC), and NNN REIT (NNN), and that’s despite having managed to grow at roughly the same pace over the long run:

| Dividend Yield | |

| GTY | 6.5% |

| O | 5.9% |

| ADC | 5% |

| NNN | 5.4% |

So why am I not buying it?

There are three key reasons.

The first one is that I fear that many of its properties will suffer permanent value destruction over the long run due to the rapid shift to EVs. Before you comment that “yes, but EVs also need to be charged and these are convenience stores…” note that I understand that. But there are better places to charge EVs than these convenience stores. Most people will charge them at home in most cases, and if they are out, they will prefer to charge their EV while at a grocery store, a restaurant, or an entertainment venue rather than wait at a small convenience store. Therefore, I believe that we won’t need nearly as many of these gas stations anymore.

I also understand that the shift to EVs will take a long time, but real estate investors are long-term oriented and if there is a risk that in 20 years your property will be vacant, then today’s value should reflect that.

Finally, I also fear that redeveloping these properties into other uses will be very expensive. I used to work for a private equity firm, and we avoided gas stations because of this exact reason. If there are or have been leaks in the past, it can get very costly to mitigate any ecological damage.

Getty Realty

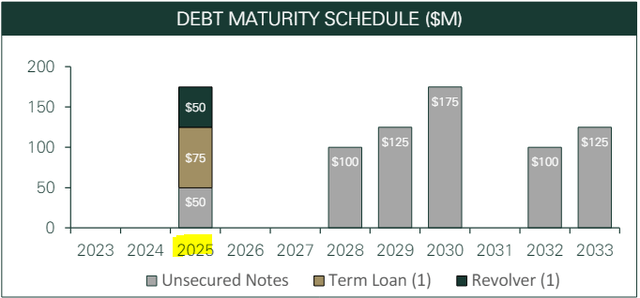

The second reason is that the company has big wall of debt maturities next year, and it will likely lead to a substantial increase in its interest expense:

Getty Realty

Some of its close peers have done a much better job with their balance sheets. NNN REIT, as an example, has a >2x longer average debt maturity than Getty Realty.

And the final reason is that you are not getting a lower valuation for accepting this higher risk. Getty is today priced at a similar valuation multiple as its close peers even despite having a weaker balance sheet, being more exposed to rising interest rates, and owning a portfolio that’s far less diversified and more exposed to the risk of decreasing property values and rents over the long run:

| FFO Multiple | |

| GTY | 12.6x |

| O | 12.5x |

| NNN | 12.5x |

Therefore, even if you disagree with my take on EVs, it still makes little sense to buy Getty. You should get rewarded with a lower valuation for taking this risk, but you are not.

Closing Note

You can greatly improve the risk-to-reward of your portfolio by being selective, and these three REITs are great examples of that. In all three cases, you could potentially earn better returns with lower risks if you simply invested in some of their close peers instead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here