Welcome to the nickel miners news for May.

The past month saw nickel prices higher.

Nickel price news

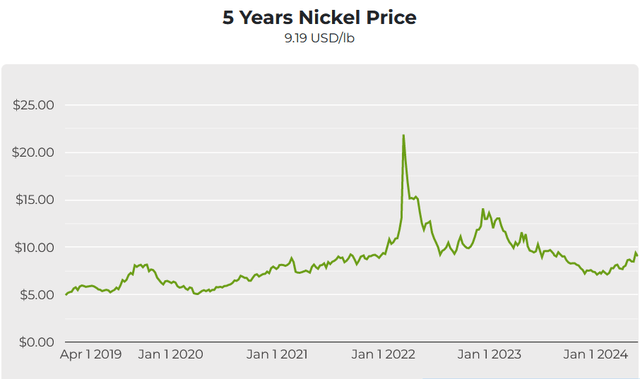

As of May 31, the nickel spot price was USD 9.19/lb, up from USD 8.67/lb last month. LME shows the price at USD 19,760/tonne. Nickel inventory at the London Metals Exchange [LME] was higher the past month at 83,634 tonnes (78,594 tonnes last month).

Nickel spot price 5 year chart – Current price = USD 9.19/lb

Mining.com

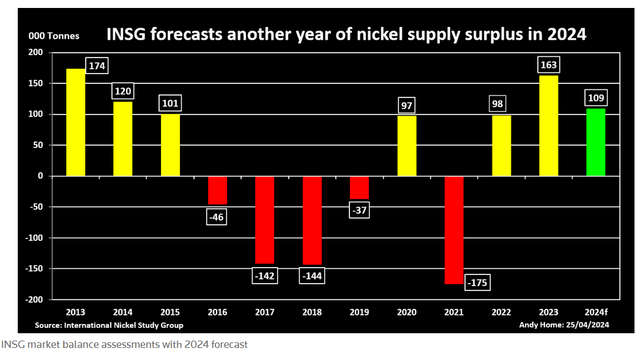

Nickel demand v supply chart

INSG forecasts a third consecutive year of nickel oversupply in 2024 (source)

Reuters courtesy INSG

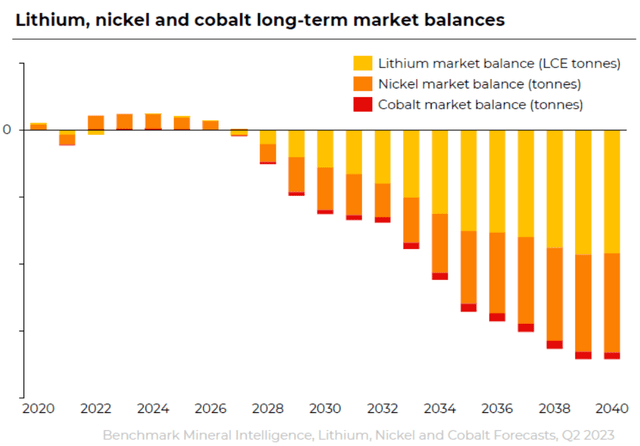

Benchmark Mineral Intelligence forecasts deficits for lithium, nickel & cobalt to increase from 2027 onwards (source)

BMI

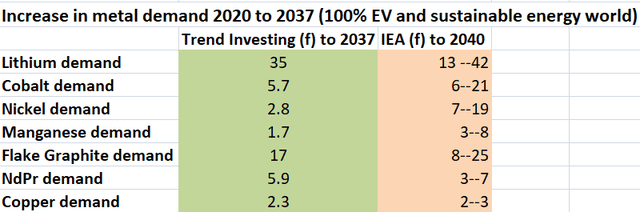

Trend Investing v IEA demand forecast for EV metals (IEA)

Trend Investing & the IEA

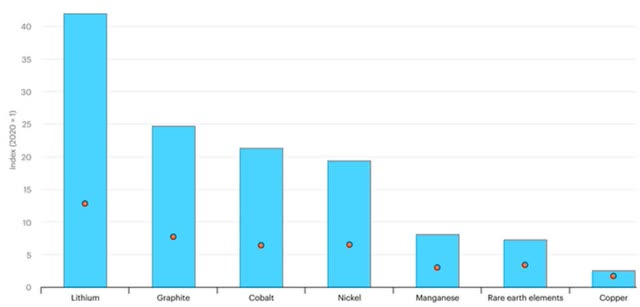

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, and Copper 2x to 3x (source)

IEA

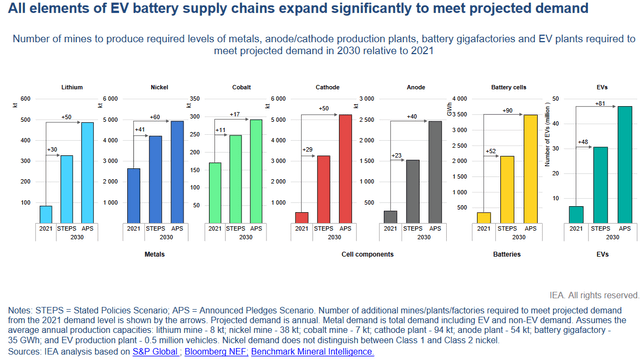

2022 – IEA forecasts 60 new nickel mines needed by 2030

IEA

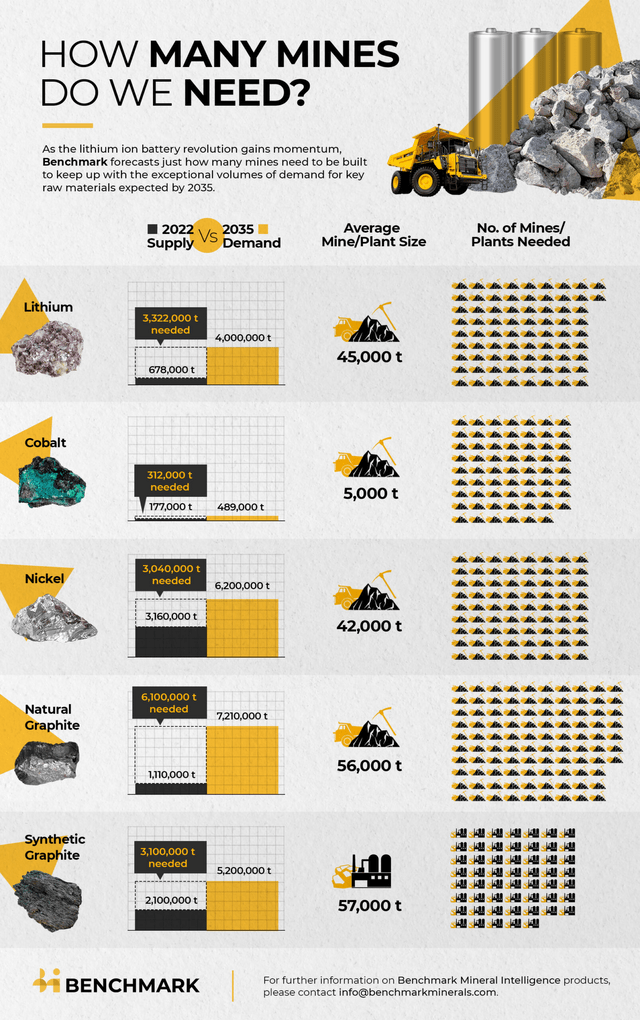

BMI forecasts we need 330+ new EV metal mines from 2022 to 2035 to meet surging demand – 72 new 45,500tpa nickel mines needed by 2035

BMI

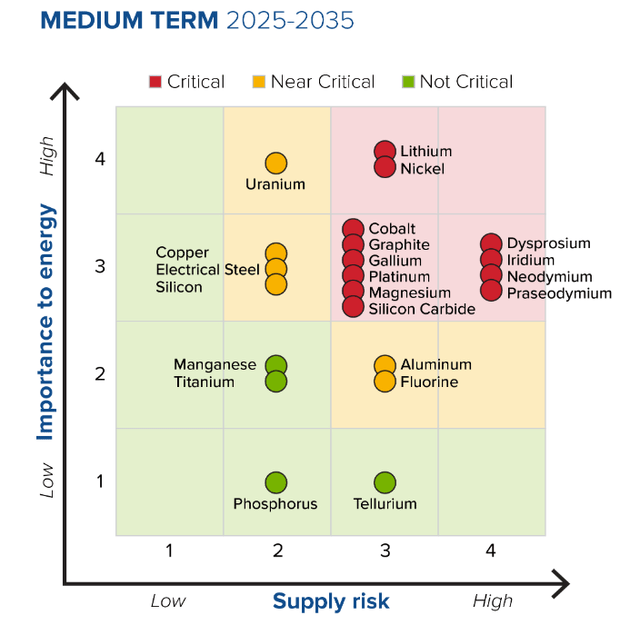

Lithium & Nickel are the two ‘high importance to energy’ critical materials in the medium term (2025-2035) (source – page 29)

DoE

Nickel market news

On May 3 Seeking Alpha reported:

U.S. government gives EV makers two year reprieve on FEOC graphite for batteries. The U.S. Treasury and Internal Revenue Service have extended tax credits for electric vehicles containing Chinese graphite for another two years, allowing EV makers more flexibility to manufacture and sell vehicles that are eligible for the $7,500 tax credit…For determining qualifying critical mineral content for purposes of the critical minerals requirement, today’s release provides a new test, the traced qualifying value add test. Under this test, manufacturers must conduct a detailed supply chain tracing to determine the actual value-added percentage for extraction, processing, and recycling. The actual percentage is used to determine the value for the applicable critical mineral that is qualifying. Manufacturers may continue to use the 50 percent roll up described in the proposed regulations as a transition rule until 2027…Friday’s ruling will expand the timetable to use graphite and other critical minerals until 2027, giving EV makers much needed breathing room to locate other sources of critical minerals that do not fall within FEOC restrictions…Once the extension runs out in 2027, the limits on foreign-made components and minerals becomes increasingly more restrictive. By 2027, 80% of critical minerals and 80% of battery components must originate in the U.S. In 2028, 90% of battery components must come from the U.S., while in 2029 80% of critical minerals and 100% of battery components must be domestic.

Note: Bold emphasis by the author.

On May 14 The White House announced:

FACT SHEET: President Biden Takes Action to Protect American Workers and Businesses from China’s Unfair Trade Practices…

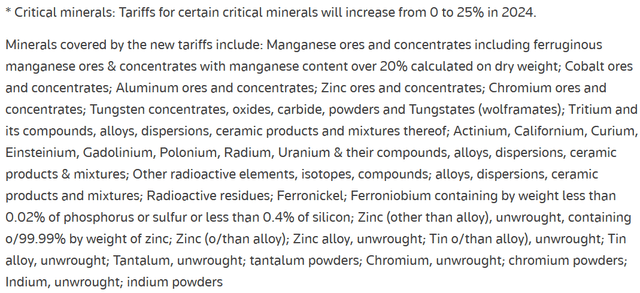

Batteries, Battery Components and Parts, and Critical Minerals

The tariff rate on lithium-ion EV batteries will increase from 7.5% to 25% in 2024, while the tariff rate on lithium-ion non-EV batteries will increase from 7.5% to 25% in 2026. The tariff rate on battery parts will increase from 7.5% to 25% in 2024. The tariff rate on natural graphite and permanent magnets will increase from zero to 25% in 2026. The tariff rate for certain other critical minerals will increase from zero to 25% in 2024.

A Reuters report shows nickel sulphate is not included in the critical minerals to receive a tariff, but ferronickel is included (source)

Reuters

On May 15 Stockhead reported:

Mission Critical: Albanese and Chalmers’ budget delivers $7bn splash for critical minerals refiners. Canberra answers miners’ prayers, with $7b production tax credit at centre of $22b Future Made in Australia program. The budget announcement could see 10% of operating costs for downstream processing in critical minerals like nickel, vanadium, lithium and rare earths returned to miners as a tax credit.

Note: Bold emphasis by the author.

On May 28 Bloomberg reported:

EU, Australia sign critical minerals pact to diversify supply chains. Ministers in Canberra and Brussels signed a memorandum of understanding on Tuesday, which will be followed by the joint development of “concrete actions” over the next six months to improve collaboration on critical minerals projects.

On May 30 Mining.com reported:

Nornickel forecasts lower global nickel surplus, bigger palladium deficit… Nornickel, the world’s largest producer of palladium and high-grade nickel, said it expected the global nickel surplus to be about 100,000 metric tons this year, down from a previous estimate of 190,000 tons. Most of the surplus would come from low-grade nickel, it said. In 2025, the nickel surplus would remain at the same level of 100,000 tons, Nornickel said in a report.

On May 30 Yahoo Finance reported:

Unrest in a French territory is driving up the price of nickel. The deadly riots that broke out earlier this month in the French territory of New Caledonia are pushing up the price of nickel…The South Pacific archipelago, located roughly 1,000 miles off Australia’s east coast, was the world’s third-largest producer last year of nickel…simmering unrest in New Caledonia, which some commentators have likened to a dawning “civil war,” has prevented any shipments or production of nickel, sending the price of the metal surging by more than 7% in recent weeks.

Nickel Company News

Producers

Norilsk Nickel

On May 23 Norilsk Nickel announced: “Nornickel presents sustainability results for 2023…”

Vale SA (NYSE:VALE)

Vale Voisey’s Bay Mine is a key Canadian and global source of nickel. Vale plans a refinery at Bécancour in Québec to supply GM with battery grade nickel sulfate with deliveries targeted to commence in H2 2026.

On April 30, Vale SA announced:

Vale announces completion of strategic partnership agreement with Manara Minerals. Following approval from the relevant regulatory authorities, Vale is pleased to announce the completion of its approximately US$2.5 billion sale to Manara Minerals, a joint venture between Ma’aden and Saudi Arabia’s Public Investment Fund, under which Manara Minerals will acquire 10% of Vale Base Metals Limited (VBM)…

On April 30, Vale SA announced: “Vale and Caterpillar sign agreement to test battery electric trucks and conduct ethanol studies…”

On May 23, Vale SA announced: “Vale updates on the CEO succession process.”

On May 27, Vale SA announced:

Vale and BNDES launch call for proposals for investment fund focused on strategic minerals projects…The call for proposals aims to stimulate mineral research and exploration activities in Brazil.

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

On April 30, Glencore announced:

First quarter production report 2024…Own sourced nickel production of 23,800 tonnes was 2,900 tonnes (14%) higher than Q1 2023, largely due to recovery from the INO supply chain constraints seen in the base period…

On May 6, Glencore announced: “Glencore sells its controlling stake in Volcan Compañia Minera…”

BHP Group [ASX:BHP] (NYSE:BHP)

BHP’s Nickel West (includes the Mt Keith nickel mine in Australia) has a Measured and Indicated Resource of 4.1Mt contained nickel with a Total Resource contained nickel of 6.3Mt, with an average grade of 0.58% Ni in sulphide ore. Nickel West produced 80 kt of nickel in FY 2020. Stage 1 production of the Kwinana Nickel Refinery is aimed to be 100ktpa nickel sulphate.

On May 13, BHP Group announced: “Revised proposal for Anglo American plc…”

On May 20, BHP Group announced: “Revised Samarco settlement offer presented in Brazil…”

On May 27, BHP Group announced: “BHP and Rio Tinto collaborate on battery-electric haul truck trials in the Pilbara.”

On May 30 Reuters reported:

BHP walks away from $49 billion pursuit of mining rival Anglo…BHP’s aim was to secure Anglo’s prized copper assets in Latin America.

BHP’s Nickel West operations

BHP

Anglo American [LSX:AAL] (OTCPK:AAUKF)

On May 13, Anglo American announced:

Statement re revised proposal from BHP…Stuart Chambers, Chairman of Anglo American, commented: “The latest proposal from BHP again fails to recognise the value inherent in Anglo American…”

Eramet [FRA:ERA] (OTCPK:ERMAY)

On May 21, Eramet announced: “Eramet: Launch of an any and all cash tender offer to repurchase its bonds due May 2025 and potential issuance of new sustainability-linked bonds.”

On May 21, Eramet announced:

Eramet: Successful issue of €500 million sustainability-linked bonds…The Bonds, scheduled for settlement on 30 May 2024, are expected to be admitted to trading on the regulated market of Euronext in Paris and rated Ba2 by Moody’s and BB by Fitch.

Sherritt International (OTCPK:SHERF)[TSX:S]

On May 8, Sherritt International announced: “Sherritt reports first quarter 2024 results; Solid performance from Power; Metals achieved strong nickel sales volume; Slurry preparation plant operating at design capacity.” Highlights include:

- “Sherritt’s share(1) of finished nickel and cobalt production at the Moa Joint Venture (“Moa JV”) was 3,597 tonnes and 342 tonnes, respectively.

- Sherritt’s share of finished nickel and cobalt sales of 4,023 tonnes and 362 tonnes, respectively, exceeded production volumes with strong spot sales driving progress on reducing nickel inventory.

- Net direct cash cost (“NDCC”)(2) was US$7.24/lb due to higher-cost opening inventory sold and lower cobalt and fertilizer by-product credits. Importantly, mining, processing and refining (“MPR”) costs, the largest component of NDCC(2), improved 13% compared to Q1 2023…

- Net loss from continuing operations of $40.9 million, or $(0.10) per share was primarily due to lower average-realized prices(2) for nickel, cobalt and fertilizers, partly offset by higher nickel sales volumes.

- Adjusted EBITDA(2) was $(6.5) million.

- Available liquidity in Canada as at March 31, 2024 was $67.9 million increasing from $63.0 million as at December 31, 2023.

- The Moa JV received a $20.0 million prepayment on a sales agreement for nickel deliveries in 2024.

- Continued implementation of an organization-wide restructuring and cost-cutting program to improve operational performance and respond to market conditions resulting in a reduction to the Corporation’s Canadian operations headcount by approximately 10% which is expected to result in annualized cost savings of $13.0 million…”

IGO Limited [ASX:IGO] (OTC:IIDDY)

No nickel related news for the month.

Sumitomo Metal Mining Co. (OTCPK:SMMYY)

On April 30, Sumitomo Metal Mining Co. announced:

Sumitomo Metal Mining and Mitsubishi Corporation to participate in Kalgoorlie Nickel Project – Goongarrie Hub…SMM and MC will establish an incorporated joint venture to fund the KNP – Goongarrie Hub Definitive Feasibility Study [DFS] up to the agreed budget of 98.5 million AUD. The SMM-MC joint venture will acquire an ultimate 50%1 interest in Kalgoorlie Nickel Pty Ltd (KNPL), the owner of the project and currently 100% held by Ardea…

On May 9, Sumitomo Metal Mining Co. announced:

FY2024 capital expenditure and total investment plan. Sumitomo Metal Mining Co., Ltd. (TSE: 5713) plans a total 174.1 billion yen of capital expenditures on a consolidated basis during the fiscal year 2024 (April 1, 2024 to March 31, 2025). The total investment represents a 16% increase from that of FY2023…

Nickel 28 Capital Corp. [TSXV:NKL] [GR:3JC]

On May 15, Nickel 28 Capital Corp. announced: “Nickel 28 releases Ramu Q1 2024 operating performance.” Highlights include:

- “Ramu Q1 2024 production of 8,282 tonnes of contained nickel in MHP, compared to 9,016 tonnes in the same period last year.

- Ramu Q1 2024 production of 767 tonnes of contained cobalt in MHP, compared to 798 tonnes in the same period last year.

- Ramu Q1 2024 nickel sales of 8,864 tonnes of contained nickel, compared to 7,914 tonnes in the same period last year.

- LME average nickel price of US$7.53/lb. in Q1 2024, a decrease of 36% from the same period the previous year.

- Fast Markets average cobalt price of US$13.49/lb. in Q1 2024, a 21% decrease from the same period last year.

- Actual cash cost, net of by-product credits of $3.00/lb. of nickel produced as MHP, compared to US$3.12/lb in the same period last year, a decrease of 4%.”

On May 28, Nickel 28 Capital Corp. announced:

Nickel 28 announces update on Ramu mineral resources and mineral reserves…Nickel 28 currently holds an 8.56% joint-venture interest in Ramu. Ramu is operated by MCC which, along with its partners, owns an 85.0% interest. Following repayment of the Company’s construction debt owed to MCC; Nickel 28’s ownership interest in Ramu will automatically increase to 11.3% at no cost to the Company. Additionally, when the Company has repaid the construction debt, the Company will have the option to purchase an additional 9.25% interest in Ramu at market value, which if exercised would take the Company’s interest to 20.55%…

Nickel Industries Limited [ASX:NIC] (OTCPK:NICMF)

On May 23, Nickel Industries Limited announced:

New US$250m term loan facility established. Nickel Industries Limited (Nickel Industries or the Company) is pleased to advise that it has executed a new US$250M term loan facility (the Facility), jointly provided by tier-1 banks PT Bank Negara Indonesia (Persero) Tbk (BNI) and DBS Bank Ltd (DBS). Following the recent repayment of the US$245M balance of the Company’s April 2024 notes, the Facility has been established to support the remaining funding requirements for the Nickel Industries’ acquisition of a 55% equity interest1 in the Excelsior Nickel Cobalt (ENC) HPAL Project, which is currently under construction within the Indonesia Morowali Industrial Park (IMIP)…

Other nickel producers

Tsingshan Holding Group Co Ltd (private, Chinese owned stainless steel producer with large nickel mines in Indonesia), First Quantum Minerals [TSX:FM] (OTCPK:FQVLF), Franco/Nevada [TSX:FNV], MMG [HK:1208], South32 [ASX:S32], Lundin Mining [TSX:LUN], Nickel Asia Corporation [PSE:NIKL], Platinum Group Metals’ [TSX:PTM] (PLG).

Nickel juniors

Horizonte Minerals Plc [TSX:HZM] [AIM:HZM]

Horizonte 100% owns the Araguaia Nickel Project (Araguaia) in Brazil. Currently suspended from trade and under Administration.

On May 16, Horizonte Minerals announced:

Notice of resolution to appoint administrators and suspension of trading in the company’s shares. Horizonte Minerals Plc (AIM/TSX: HZM) (“Horizonte” or the “Company”) has been unable to secure interest in the full financing needed to complete its 100% owned Araguaia Nickel Project (“Araguaia” or the “Project”). After a period of discussions with secured creditors, and existing and new potential investors on alternative scenarios with a view to a potential restructuring solution to attempt to achieve the best possible recovery for the Company’s creditors while minimising potential liabilities, the Board has now regrettably concluded that Horizonte should be placed into administration in order to seek to preserve the value of the business for creditors and other stakeholders. Accordingly, the Board has resolved to appoint Geoff Rowley and Chad Griffin of FRP Advisory as administrators and is in the process of making such appointment. In light of the above, the Company has requested a suspension of trading in its ordinary shares on AIM with effect from 7.30am on 16 May 2024 and TSX with effect from 6.00pm on 15 May 2024. The Final Results for the year ending 31 December 2023 will not be released.

Poseidon Nickel [ASX:POS] (OTC:PSDNF)

On May 9, Poseidon Nickel announced:

Update on proposed sale of Lake Johnston…On 8 May 2024 the Company received a notice of termination from MRL in respect of the Binding Heads of Agreement entered into by both parties on 15 March 2024 (refer to ASX announcement “Binding Heads of Agreement for the sale of Lake Johnston” dated 18 March 2024).

On May 17, Poseidon Nickel announced: “Lake Johnston project update.” Highlights include:

Recommencement of Lake Johnston Exploration

- “Preparation for Reverse Circulation drilling at Maggie Hays West is underway, a compelling greenfields nickel sulphide target with coherent, Ni-Cu-PGE regolith anomaly defined in shallow Aircore drilling over 1km. Best drill interval grading up to 2.37% Ni, 624ppm Cu and 353ppb Pt+Pd3.”

On May 30, Poseidon Nickel announced: “Low cost, near surface exploration targets identified at Black Swan.” Highlights include:

- “Validation of two near surface high grade nickel exploration targets at Black Swan.

- Further reduction of annualised operating costs by up to $1.0 million through optimised care and maintenance at Black Swan, bringing total annualised cost reductions up to $5.8 million.”

Talon Metals [TSX:TLO] (OTCPK:TLOFF) Tamarack – (JV with Rio Tinto)

Tamarack is a high grade nickel-copper-cobalt project located in Minnesota, USA, with considerable exploration upside. Talon Metals owns a 51% project share, with potential to further earn-in to a 60% share by 2026.

On May 2, Talon Metals announced: “Talon Metals reports 14 new holes intersect nickel-copper mineralization in the Raptor Zone.” Highlights include:

- “14 New Drill Holes Intersect Nickel-Copper Mineralization…(assays pending)…These findings mark a significant advancement in understanding the extensive nickel and copper potential of the area.

- Detection of Strong Electromagnetic (Geophysics) Anomaly: Drill hole 23TK0480A, in addition to intersecting massive sulphide mineralization (assays pending), has identified one of the strongest borehole electromagnetic anomalies within the Raptor Zone to date (see Figure 2 below). This anomaly, modeled as a 30x30m plate at 4000 siemens, projects to the expected continuation of the channel of mineralization, further indicating the potential for additional high-grade nickel-copper mineralization.

- Identification of Thick Nickel Mineralization Accumulation: The thickest accumulation of mineralization (up to 10 meters thick) is associated with a channel in the basal contact…

- Extensive and Continuous Mineralization: The Raptor Zone appears to be continuously mineralized along the base (upwards of 4 km x 2 km of mineralization). Talon continues to actively drill in the Raptor Zone.”

On May 15, Talon Metals announced: “Talon Metals reports results for the quarter ended March 31, 2024…”

On May 22, Talon Metals announced: “Talon Metals intercepts 4.81 meters grading 4.89% Ni, 4.10% Cu, 0.06% Co, 4.10 g/t Pd, 6.10 g/t Pt and 7.16 g/t Au (9.26% NiEq).” Highlights include:

- “New Drill Hole 24TK0503 Intercepts High-Grade Massive Sulphide Mineralization: Intercepts 4.81 meters at 4.89% Ni, 4.10% Cu, 0,06% Co, with notably high Platinum Group Elements (“PGEs”), averaging 17.45 g/t Pd+Pt+Au (9.26% NiEq);

- Two Significant Intercepts in the Same Drill Hole: Drill Hole 24TK0503 has a second intercept of 79.22 meters at 0.80% NiEq;

- Near-Resource Expansion Potential: The “CGO East Waterfall” is approximately 120 meters below CGO East, representing low-hanging fruit for further exploration (see Figure 4);

- Analogous Waterfall Features: The CGO East Waterfall mirrors a previous discovery named the CGO West Waterfall (see Figure 3) in depth, grade, nickel tenor, and PGEs, highlighting true geological analogies across the Tamarack Resource Area;

- Next Steps for Exploration: Talon plans to use its borehole EM technology (geophysics) to gain deeper insights into the new CGO East Waterfall area, which will be followed up by additional drilling.”

Garibaldi Resources [TSXV:GGI] [GR:RQM] [LN:OUX6] (OTCPK:GGIFF)

No news for the month.

Queensland Pacific Metals [ASX:QPM]

On May 6, Queensland Pacific Metals announced:

R&D tax refund of $15.8m received…A short term loan of $12.6m taken out against the R&D tax refund has now been repaid back in full.

On May 16, Queensland Pacific Metals announced: “Successful capital raising of $19.1m.”

Premium Nickel Resources Corporation [TSXV:PNRL](OTCQX:PNRLF)

On May 16, Premium Nickel Resources Corporation announced:

Premium Nickel reports 17.55 metres of 3.28% NiEq or 6.16% CuEq (2.07% Ni, 1.98% Cu, 0.11% Co) at Selebi North Underground, 403 metres down plunge of the historic resource…

Canada Nickel Company [TSXV:CNC](OTCQX:CNIKF)

On May 6, Canada Nickel Company announced: “Canada Nickel continues to achieve excellent drill results at Reid.” Highlights include:

- “New best interval to date at Reid – 687 metres of 0.27% nickel including 36.0 metres of 0.41% nickel and 7.5 metres of 0.56% nickel in REI24-18.

- All four holes intersected core lengths of at least 676 metres with average grades of 0.24% to 0.27% nickel.”

On May 13, Canada Nickel Company announced:

Canada Nickel achieves initial metallurgical success at Mann Northwest Property. First two metallurgical tests at Mann deliver strong recovery and concentrate quality: Overall nickel recoveries of 58% and 59%. Nickel and magnetite concentrate grades in line with expectations.

Ardea Resources [ASX:ARL] (OTCPK:ARRRF)

In total, Ardea has 6.1Mt of contained nickel and 386,000t of contained cobalt at their KNP Project near Kalgoorlie in Western Australia. Ardea is also exploring for gold and nickel sulphide on their >5,100 km2 of 100% controlled tenements in the Eastern Goldfields region of Western Australia.

On April 26 Ardea Resources announced:

Ardea, Sumitomo Metal Mining (SMM) and Mitsubishi Corporation [MC] to form a Joint Venture to develop the Kalgoorlie Nickel Project (KNP) – Goongarrie Hub…The Consortium will fund 100% of the DFS costs up to the agreed budget of approximately A$98.5 million and assist KNPL in optimising debt financing to earn an ultimate 50% interest in the JV, with Ardea retaining the other 50%…In addition, Ardea, SMM and KNPL have agreed on funding support arrangements allowing DFS activities to continue in Q2 2024. Transaction completion is expected prior to the end of Q3 2024.

Centaurus Metals Limited [ASX:CTM] (OTCQX:CTTZF)

Centaurus Metals is an Australian-based minerals exploration company focused on the near-term development of the Jaguar Nickel Sulphide Project, in Northern Brazil.

On May 27, Centaurus Metals Limited announced:

Maiden Greenfields drilling program underway at 100%-owned Boi Novo copper-gold project, Brazil…The Company remains well-funded to carry out the maiden drill program in parallel with ongoing pre-development and financing activities for the Company’s flagship Jaguar Nickel Sulphide Project.

On May 28, Centaurus Metals Limited announced: “Maiden Greenfields Drilling Program at Boi Novo – Amended…”

Alliance Nickel [ASX:AXN] (formerly GME Resources)

On May 9, Alliance Nickel Limited announced: “NiWest Nickel Cobalt Project granted major project status by Australian Government.” Highlights include:

- “…MPS will provide Alliance with access to the Major Projects Facilitation Agency, providing additional resources to assist streamlining a range of regulatory approvals for mine development.

- NiWest is the first nickel project in Australia awarded MPS since nickel was added to Critical Minerals List in February 2024.”

On May 9, Alliance Nickel Limited announced:

Amendment to ASX announcement. Alliance Nickel Limited (ASX:AXN) advises that it has updated the announcement released this morning (NiWest Granted Major Project Status by Australian Government). The attached amended announcement now includes reference to the ASX market announcement released on 21 July 2022 entitled PFS Outcomes for NiWest Nickel-Cobalt Project. Alliance Nickel also confirms that it is not aware of any new information or data that materially affects the information included in this market release.

Widgie Nickel [ASX:WIN]

No significant news for the month.

Sama Resources [TSXV: SME] [GR;8RS] (OTCPK:SAMMF)

The Samapleu-Grata Nickel-Copper Project is a 60/40 joint venture between Ivanhoe Electric and Sama Resources.

On May 3, Sama Resources announced:

Sama Resources announces filing of NI 43-101 technical report on Samapleu-Grata Nickel-Copper Project, Côte d’Ivoire…

Murchison Minerals [TSXV:MUR] (OTCQB:MURMF)

No nickel related news for the month.

Power Nickel [TSXV:PNPN] (CMETF)

On May 10, Power Nickel announced: “Power Nickel delineates new polymetallic discovery.” Highlights include:

- “PN-24-048 returned, 15.27 m of 0.50 g/t Au, 16.13 g/t Ag, 1.89% Cu, 7.07 g/t Pd, 1.26 g/t Pt and 0.80% Ni…and 0.06% Ni, 1.70 m of 1.27 g/t Au, 99.84 g/t Ag, 12.30% Cu, 15.45 g/t Pd, 0.60 g/t Pt and 0.38% Ni.

- PN-24-052 returned, 11.35 m of 0.26 g/t Au, 6.12 g/t Ag, 0.63% Cu, 1.57 g/t Pd, 0.67 g/t Pt and 0.04% Ni…and 0.03% Ni 2.85 m of 0.22 g/t Au, 10.44 g/t Ag, 1.36% Cu, 3.54 g/t Pd, 0.82 g/t Pt, and 0.08% Ni.

- PN-24-053 returned 5.00 m of 1.76 g/t Au, 102.90 g/t Ag, 12.70% Cu, 20.87 g/t Pd, 1.02 g/t Pt and 0.40% Ni…”

On May 21, Power Nickel announced:

Power Nickel’s Lion Discovery makes an enormous roar – 15.4 metres of over 9.5% copper equivalent…PN-24-055 returned: 15.40 m of 0.44 g/t Au, 22.04 g/t Ag, 5.06% Cu, 13.12 g/t Pd, 3.35 g/t Pt and .015% Ni…

The Metals Company (TMC)

On May 13, The Metals Company announced: “TMC subsidiary submits its largest deep-sea environmental data set yet to International Seabed Authority.”

On May 13, The Metals Company announced: “TMC announces first quarter 2024 results.” Highlights include:

- “$11.9 million cash used in operations for the quarter ended March 31, 2024.

- Net loss of $25.2 million and net loss per share of $0.08 for the quarter ended March 31, 2024.

- Total liquidity of approximately $49 million at March 31, 2024, inclusive of:

- Cash of $4.0 million.

- The $25 million unsecured credit facility from an affiliate of Allseas Group SA with a maturity date of August 2025.

- The $20 million unsecured credit facility with a maturity date of September 2025 provided by our largest shareholder, ERAS Capital LLC (the family office of TMC director Andrei Karkar), and our Chairman & CEO, Gerard Barron.

- Subsequent to March 31, 2024, TMC has drawn approximately $2.9 million on the unsecured credit facility provided by ERAS Capital LLC and Gerard Barron.”

On May 23, The Metals Company announced: “TMC commends U.S. House of Representatives for allocating defense funding to assess the feasibility of domestic nodule refining capacity.” Highlights include:

- “As reported by the Wall Street Journal, the House version of the fiscal year 2025 National Defense Authorization Act (NDAA) calls for $2 million allocated to the Defense Department’s Industrial Base Policy Office to study the feasibility of developing domestic capacity to refine polymetallic nodule-derived intermediates to high-purity nickel, copper and cobalt products. The legislation also proposes to examine existing supply chains for such intermediates.

- In addition, TMC’s U.S. subsidiary has an outstanding application seeking a $9 million grant under the Pentagon’s Defense Production Act Title III program for feasibility work on a domestic refinery for nodule-derived intermediate products.

- With TMC’s commercial-scale nodule collection from its NORI-D Area targeted to begin at the end of Q1 2026 and a binding memorandum of understanding in place with Pacific Metals Co. of Japan for primary processing, the prospect of refining the resulting NiCuCo intermediate product to high-purity products in the United States could bolster domestic production of clean energy, infrastructure and defense technologies.”

Other juniors

Artemis Resources [ASV:ARV], Australian Mines [ASX:AUZ], Azure Minerals [ASX:AZS] (OTCPK:AZRMF), Blackstone Minerals [ASX:BSX], Cassini Resources [ASX: CZI], Class 1 Nickel and Technologies Ltd. [CSE:NICO] (OTCQB:NICLF), Electra Battery Materials [TSXV:ELBM] (ELBMF), Electric Royalties [TSXV:ELEC], EV Nickel [TSXV:EVNI] (OTCPK:EVNIF), Flying Nickel Mining Corp. [TSXV:FLYN], FPX Nickel [TSXV:FPX], Grid Metals Corp [TSXV:GRDM], Go Metals [CSE:GOCO] (OTCPK:GOCOF), Huntsman Exploration [TSXV:HMAN] (OTCPK:BBBMF), Inomin Mines [TSXV:MINE], Jervois Global Limited [ASX:JRV] (OTCQB:JRVMF), New Age Metals [TXV:NAM], Nickel Creek Platinum [TSX:NCP] (OTCQX:NCPCF), Nordic Nickel Limited [ASX:NNL], Pancontinental Resources Corporation [TSXV:PUC], Polymet Mining [TSX:POM], Renforth Resources [CSE:RFR] (OTCQB:RFHRF), Rox Resources [ASX:RXL], S2 Resources (ASX:S2R), Stillwater Critical Minerals [TSXV:PGE] (OTCQB:PGEZF), Sunrise Energy Metals [ASX:SRL] (OTCQX:SREMF), Surge Battery Metals Inc. [TSXV:NILI] [FRA:DJ5C] (OTCQX:NILIF), Talisman Mining Ltd. [ASX:TLM], Tartisan Nickel Corp. [CSE:TN] (OTCQB:TTSRF), Transition Metals [TSXV:XTM], URU Metals Ltd. [LSE:URU] [GR:NVRA], Wall Bridge Mining [TSX:WM], and Zeb Nickel Corp. [TSXV:ZBNI] (OTCQB:ZBNIF).

Note: Some of the above companies are covered in the Cobalt monthly news.

Nickel miners ETF

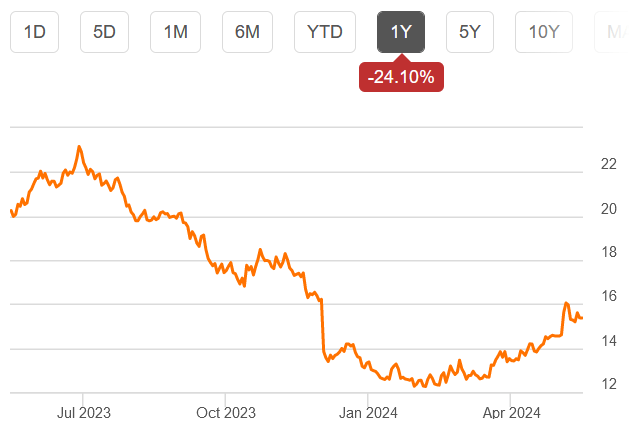

Below is the Sprott Nickel Miners ETF. You can view the top holdings here.

Sprott Nickel Miners ETF (NIKL) – One year price chart – Price = US$15.37

Seeking Alpha

Conclusion

Nickel spot prices were higher the last month.

Highlights for the month were:

- Mission Critical: Albanese and Chalmers’ budget delivers $7bn splash for critical minerals ‘refiners’.

- U.S. government gives EV makers two year reprieve on FEOC rules for graphite and other critical minerals for batteries.

- President Biden introduces a new tariff on imports stating certain other critical minerals will increase from zero to 25% in 2024.

- EU, Australia sign critical minerals pact to diversify supply chains.

- Nornickel expects the global nickel surplus to be about 100,000 metric tons this year, and a similar amount in 2025. Most of the surplus would come from low-grade nickel.

- Unrest in New Caledonia is driving up the price of nickel.

- Vale – Manara Minerals will acquire 10% of Vale Base Metals for ~US$2.5b.

- Glencore Q1 own sourced nickel production of 23,800 tonnes, up 14% YoY.

- BHP walks away from $49 billion pursuit of mining rival Anglo.

- Sherritt International Q1 Net loss from continuing operations of $40.9 million, or $(0.10) per share was primarily due to lower average-realized prices for nickel, cobalt and fertilizers.

- Nickel Industries Limited – New US$250m term loan facility established.

- Horizonte Minerals – Notice of resolution to appoint administrators and suspension of trading in the company’s shares.

- Poseidon Nickel receives notice of termination from MRL in respect to the sale of Lake Johnston.

- Talon Metals reports 14 new holes intersect nickel-copper mineralization in the Raptor Zone.

- Premium Nickel reports 17.55 metres of 3.28% NiEq or 6.16% CuEq (2.07% Ni, 1.98% Cu, 0.11% Co) at Selebi North Underground.

- Ardea, Sumitomo Metal Mining (SMM) and Mitsubishi Corporation [MC] to form a Joint Venture to develop the Kalgoorlie Nickel Project (KNP) – Goongarrie Hub. Ardea to retain 50% of the JV.

- NiWest Nickel Cobalt Project granted major project status by Australian Government.

- Power Nickel delineates new polymetallic discovery. Lion Discovery makes an enormous roar – 15.4 metres of over 9.5% copper equivalent.

As usual, all comments are welcome.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here