A dollar a day was the typical wage when the railroads were being built. Today the minimum wage is $58 per day with discussions to raise it to $120. According Milton Friedman, this is the result, not the cause, of inflation. Dr. Friedman researched inflation back to the Romans and concluded the reason for inflation is the government printing of money. He referred to inflation as “taxation without representation.”

The resent 9% inflation spike experienced in June of 2022 is permanent. There are no plans to deflate or reduce that 9% going forward. There appears to be only plans attempting to reduce, but not eliminate, budget deficits in the future. Budget deficits cause more printing of money, and therefore continued inflation. The projected 2024 deficit is $1.8 trillion, which is 26% of the entire proposed federal budget.

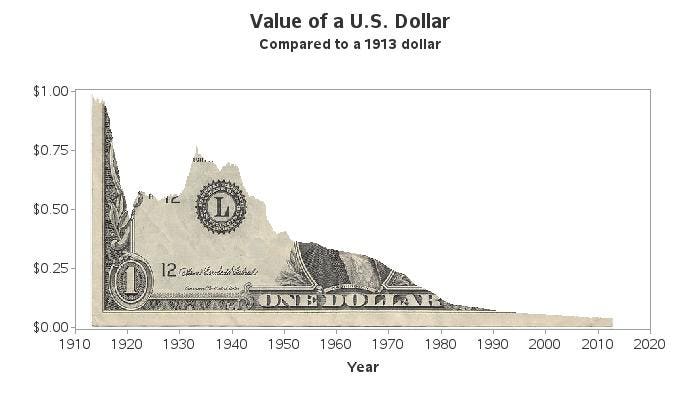

Since the formation of the CPI index, the long-term average inflation rate is only 3%. However, at that rate a dollar still depreciates to 74 cents in a decade, and to 22 cents in 50 years. The dollar has lost over 96% of its value since the Federal Reserve was founded in 1913. By all indications, all past and future losses from inflation will be permanent. The cure is less government spending which is Kryptonite to politicians who would risk being voted out of office. There are no plans to reduce spending in order to balance the budget.

With the recent rise in interest rates, the bond market may offer an opportunity to break even with inflation. However, if the interest earned is taxed and spent, there is no inflation hedge. Growing companies with product pricing power may enable the equity markets to overcome the downward pressure, although stock volatility is historically higher than bonds. A well-structured investment approach is imperative to counterbalance the permanently diminishing value of the dollar.

In 2002 Equitas Capital Advisors, LLC was established as a unique company that blends the resources of a large global corporation with the flexibility of a small boutique firm. The registered service mark of Equitas Capital Advisors is Engineering Financial Solutions® and the purpose of Equitas is to design, build, and deliver investment solutions to meet the goals and objectives of our investors. Equitas Capital Advisors, LLC located in New Orleans, has over 260 years of combined investment management consulting experience providing professional investment management services to investors such as foundations, endowments, insurance companies, oil companies, universities, corporate retirement plans, and high net worth family offices.

Disclosures and Disclaimers:

Above information is for illustrative purposes only and has been obtained from reliable sources but no guarantee is made with regard to accuracy or completeness. It is not an offer to sell or solicitation to buy any security. The specific securities used are for illustrative purposes only and not a recommendation or solicitation to purchase or sell any individual security.

Equitas Capital Advisors, LLC is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the advisor has attained a particular level of skill or ability.

Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author on the date of publication and are subject to change. This publication does not involve the rendering of personalized investment advice.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor. Charts and references to returns do not represent the performance achieved by Equitas Capital Advisors, LLC, or any of its clients.

Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. All investment strategies have the potential for profit or loss. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark. Past performance does not guarantee future investment success.

Read the full article here