Introduction

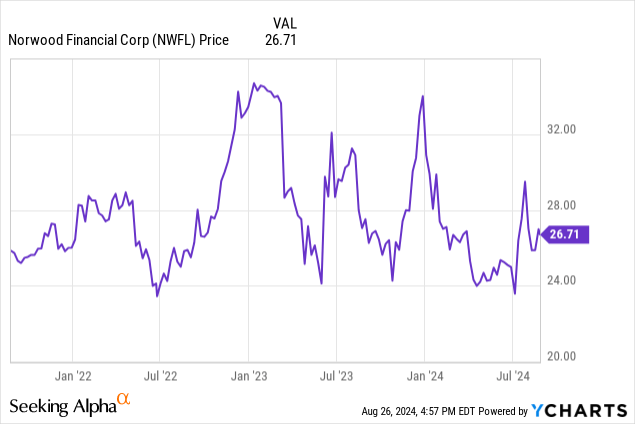

Norwood Financial (NASDAQ:NWFL) owns the Wayne Bank in Pennsylvania. I have been keeping eyes on Norwood for a few years now, but for the past little while, I assigned a ‘hold’ rating to this regional/local bank. The bank’s earnings profile is still pretty robust, but I also would like to keep tabs on the quality of its loan book.

A closer look at the net interest income and the loan loss provisions

When I’m looking at regional and local banks, I try to focus on two specific elements: How is the net interest income evolving (that’s more important for smaller banks as they usually don’t generate a decent amount of fees on for instance investment banking), and should I be worried about the balance sheet.

In the second quarter of this year, the total interest income increased by approximately $4.4M on a YoY basis. That’s good to see, but unfortunately the total interest expenses increased by $5.1M which ultimately resulted in a contraction of the net interest income which decreased by just over 4% to $14.9M.

NWFL Investor Relations

The income statement of Norwood Financial explains why the net interest income is so important for smaller, local banks. As you can see above, the total non-interest income was just $2.2M, while the total non-interest expenses increased to $11.4M. This resulted in a pre-tax and pre loan loss provision of approximately $5.7M. The bank recorded a $0.35M provision to cover future loan losses and this reduced the pre-tax income to $5.34B, resulting in a net profit of $4.2M or $0.52 per share. And as the total EPS in the first quarter was approximately $0.55, the H1 2024 EPS comes in at $1.07M. Keep in mind, this includes the reversal of loan loss provisions to the tune of just over $0.6M in the first quarter of this year.

Looking at the balance sheet, Norwood has about $2.24B in assets and fortunately, it runs a very liquid balance sheet. As you can see below, the bank holds almost $70M in cash and close to $400M in securities available for sale. There are no securities held to maturity, so there are no unrealized losses in that segment.

NWFL Investor Relations

That being said, my main area of interest is the $1.62B loan book. Most of the loans are real estate related, and about 40% of the total loan book consists of commercial real estate. I don’t mind seeing the commercial loans nor the residential mortgages, and I’m even fine with the almost $300M in consumer loans. But I’d like to make sure the quality of the CRE Loans remains strong.

NWFL Investor Relations

Looking at the balance of the loans that are currently classified as past due, the situation seems to be pretty much under control. As the image below shows, about 75% of all non-accruing loans can be found in the CRE segment (that’s not a surprise) and that definitely is an uptick from the $2.2M at the end of last year.

NWFL Investor Relations

However, there is a simple explanation for that, as the loans that were in the 31-60 days past due category at the end of last year moved towards non-accrual. And if you’d look at the combination of past due and non-accruing loans, the total in the CRE segment actually decreased by $2M compared to the end of last year.

NWFL Investor Relations

And looking at the recent evolution of the percentage of loans that are past due (shown above), Norwood Financial still seems to have a good handle on things.

Investment thesis

At the current share price, I’m still a ‘hold’ on Norwood. The stock is trading at about 13-14 times earnings and a premium of almost 50% to its tangible book value, and both elements don’t make it very appealing to initiate a long position in Norwood Financial.

I’m on the sidelines. I’m quite confident the bank will be able to sort out its loan book issues, but I’d like to see a stronger performance before getting in.

Read the full article here