Shares of Snowflake (NYSE:SNOW) fell sharply after the cloud-focused software company reported earnings for its second fiscal quarter, which on one hand included EPS and top-line beats, but on the other revealed a Q3 guidance that was perceived as weak. Snowflake still reported a good net retention rate and generated a solid amount of free cash flow considering seasonal Q2 effects. In my opinion, the market overreacted to Snowflake’s earnings report, and I see this drop as another buying opportunity for investors who want to build a position in a fast-growing cloud/software company!

Previous Rating

I rated shares of Snowflake a strong buy in June 2024 and recommended investors to buy the drop at the time – Time To Load Up The Truck – in large part because the software maker ramped up its free cash flow rapidly and generated healthy FCF margins. While I agree that Snowflake’s revenue outlook for Q3 could have been a little bit better, I believe the market overreacted to Snowflake’s financial results, and the 15% price correction was not warranted.

Snowflake’s Q2

The cloud-based software company generated better-than-expected bottom and top-line results for its second fiscal quarter: Snowflake earned $0.18 per share in adjusted EPS, beating the average Wall Street estimate by $0.02 per share. At the same time, revenue came in higher than expected at $869M, beating the consensus prediction by $18M.

Seeking Alpha

Snowflake’s results were chiefly driven by strong momentum in the enterprise market which is the company’s target area for its cloud-based software solutions. Although the company’s core product revenues grew 30% year-over-year to $869M in the second fiscal quarter, Snowflake suffered a 4 PP revenue deceleration compared to the previous quarter.

Moderating top-line growth has been a defining theme for Snowflake after the pandemic, but I still believe that 30% revenue growth in the core product group is quite impressive. Snowflake has a strong customer acquisition strategy which is the main driver for the firm’s top-line growth: in the second quarter, Snowflake grew its customer base by a massive 21% Y/Y, and its customer total at the end of the June quarter was 10,249.

Snowflake

In my last work on Snowflake, I indicated that the firm’s growing free cash flow was a reason to buy shares. Snowflake did not generate as much free cash flow in Q2’24 as it did in the previous quarter, however, mainly because the first and fourth quarters are typically the strongest quarters for software companies in terms of billing.

Enterprise customers tend to make decisions about their software contracts at the end of the year, meaning free cash flows spike in Q1 and Q4. Despite this seasonality effect, Snowflake generated a healthy amount of free cash flow from the Cloud platform in the amount of $58.8M while the free cash flow margin fell to 7%, showing a 3 PP decline year-over-year. According to Snowflake’s guidance, however, the company expects a full-year free cash flow margin of 26% (compared to 29% last year).

|

$ in thousands |

Q2’24 |

Q3’24 |

Q4’24 |

Q1’25 |

Q2’25 |

Y/Y Growth |

|

Product Revenue |

$640,209 |

$698,478 |

$738,090 |

$789,587 |

$829,250 |

30% |

|

Professional Services |

$33,809 |

$35,695 |

$36,609 |

$39,122 |

$39,573 |

17% |

|

Total Revenue |

$674,018 |

$734,173 |

$774,699 |

$828,709 |

$868,823 |

29% |

|

Net Cash from Operating Activities |

$83,191 |

$120,907 |

$344,580 |

$355,468 |

$69,865 |

-16% |

|

Property, Plant & Equipment |

($6,298) |

($8,746) |

($13,072) |

($16,519) |

($5,043) |

-20% |

|

Capitalized Software Development Costs |

($7,874) |

($9,889) |

($7,029) |

($7,404) |

($5,992) |

-24% |

|

Free Cash Flow |

$69,019 |

$102,272 |

$324,479 |

$331,545 |

$58,830 |

-15% |

|

Free Cash Flow Margin |

10% |

14% |

42% |

40% |

7% |

3 PP |

(Source: Author)

One of the most important key metrics for a software maker is the net retention rate which shows investors to what degree companies are capable of growing their platform revenues organically: Snowflake’s net retention rate in the second fiscal quarter was 127%, showing a quarter-over-quarter decline of 1 PP. This figure means that customers in the same cohort spent 27% more on Snowflake’s products and services than in the earlier reporting period.

Typically, a net retention rate, which sometimes is called a dollar-based net retention rate, above 120% is considered a strong financial achievement. In the case of Snowflake, obviously, the software maker is doing well here, although it should be noted that the company is seeing a declining trend in its net retention rate.

Snowflake

Guidance for Q3’24

What ticked investors off on Thursday, and which explains the 15% price drop after earnings results, was the guidance for the third fiscal quarter. The company projected Q3’24 revenues to fall into a range between $850M and $855M, showing a top-line growth rate of 22%. While this growth rate met expectations, the company continues to see decelerating revenue growth.

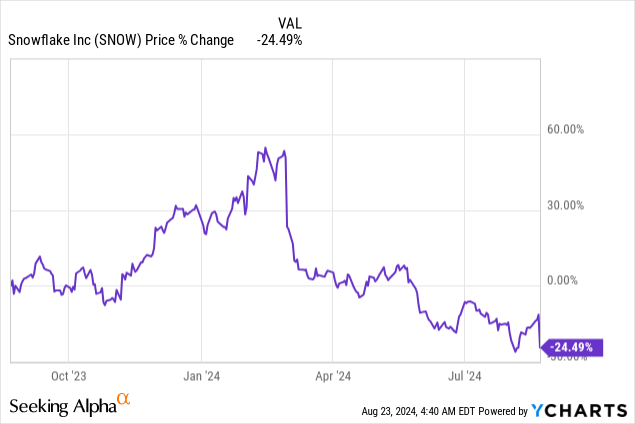

Snowflake’s Shares Trade Near 1-year Lows…

Snowflake’s shares continue to be highly valued, which is not unusual for software/Cloud companies that are growing their top lines at double-digits annually. Snowflake is currently projected to generate 26% revenue growth in its current fiscal year (FY 2025), which is in line with its product revenue guidance, and 23% in FY 2026.

Based off of revenue, Snowflake is trading at an 8.9X price-to-revenue ratio, which is actually quite cheap in a historical context: Snowflake is trading (58%) below its 3-year average P/S ratio of 21.0X. Fast-growing software markers I am comparing Snowflake to include Zscaler (ZS), Cloudflare (NET), and Datadog (DDOG). The industry group average P/S ratio here is about 11X.

If Snowflake were to revalue to just the industry group average P/S ratio, I believe SNOW could revalue to at least $142 per share. However, given that Snowflake is growing its top line at 20%+ growth rates annually and is highly free cash flow profitable, Snowflake’s shares could ultimately even revalue higher, considering that the company didn’t lose any of its customer acquisition momentum and free cash flow strength. With shares now trading close to 1-year lows, and the company’s business fundamentals being fully intact, I am buying the crash hand over fist.

Risks with Snowflake

Incrementally growing pressure on the net retention rate is a risk for Snowflake as it would represent organic revenue growth challenges. This may weigh on the company’s growth profile and likely results in further top-line moderation. What would change my mind about Snowflake is if the company were to see a decline in its free cash flows and margins, or if it started to lose customers in the enterprise segment.

Final Thoughts

Snowflake reported solid second-quarter results on Wednesday, but the market responded very sensitively to the company’s guidance for Q3’24. However, Snowflake is still growing quickly, at current rates of 30% Y/Y, and the company is widely free cash flow profitable. The software maker is also growing its customer base and doesn’t really have any major acquisition or retention challenges. From this point of view, I believe the market overreacted to Snowflake’s Q2’24 earnings report. With shares now trading at close to 1-year lows, I confirm my strong buy rating for Snowflake. I have not seen anything in the company’s earnings report that would fundamentally show a weakening investment thesis, and I believe the risk profile for long-term investors is still favorable here.

Read the full article here