Global markets extended their losses in Asian trading as concerns about a global recession continued to weigh on sentiment. In Japan, the Nikkei has dropped by as much as 12%, marking its largest two-day decline in history with a total loss of 18.2%.

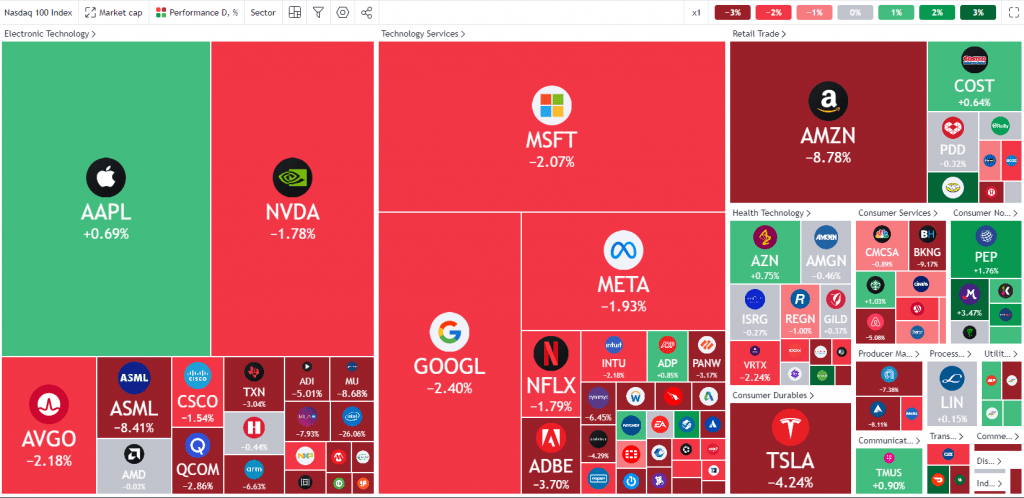

The Nasdaq 100 fell by as much as 6.5% as the “Magnificent 7” stocks continued to decline, with Nvidia (NVDA) down approximately 8.8% in pre-market trading. This has firmly placed the index in correction territory. A report indicating that the company’s new AI chip will be delayed did not help matters, though the selloff is more attributable to global sentiment.

Source: TradingView

Despite the economic slowdown that markets are anticipating, the magnitude of the selloff does resemble panic-selling in many ways. However, given the unprecedented rally in the first half of 2024, much of this could also be attributed to profit-taking and repositioning. The S&P 500 (SPX) exemplifies this shift, having shed only 3% month-to-date (MTD) and down around 7% from its recent all-time high of approximately 5669.

Safe havens experienced some gains this morning, with gold opening higher and reaching a peak of $2458/oz before retreating. Currently, the precious metal is down around 0.5% for the day. In the forex market, the Yen and the Swiss Franc have benefited from rising safe haven appeal and the unwinding of carry trades.

Changes in rate cut expectations have been accompanied by an increase in recession probabilities. Goldman Sachs has raised its 12-month recession odds by 10 percentage points to 25%, according to an analyst note. Goldman further indicated that another weak job report in September could prompt a 50 basis points cut by the Federal Reserve.

Meanwhile, geopolitical tensions in the Middle East continue to keep market participants on edge. This was exacerbated by the Australian Government raising its terrorism threat level to “probable” from “possible,” citing a global rise in politically motivated violence and extremism. This move could be in response to widespread riots across the UK over the weekend, which targeted immigration.

With markets already contending with a range of external threats, these new developments only add another layer of uncertainty moving forward.

US Earnings and Data Releases

Later in the day we will get a peak at the employment numbers from the service sector as the ISM non-manufacturing data is released. This will be the major piece of economic data from the US and could mean that market moves will largely be driven by external factors this week.

On the earnings front, Disney (DIS) will report this week but Caterpillar (CAT) will likely get more attention. Caterpillar may provide some insight into the state of the consumer and manufacturing as well.

Technical Analysis Nasdaq 100

From a technical perspective, the Nasdaq 100 is in correction territory. Last week’s selloff continued into the Asian session, with the index tapping into a key support area around 17300 before a significant rebound. At the time of writing, the index is trading at 17730.

Price is currently testing the 200-day moving average (MA), and a continued selloff could see the index revisiting the daily low around the 17300 level. A break below this point opens up the possibility of testing support at the 17000 mark and potentially the 16600 mark.

Conversely, a deeper retracement and some dip buying could push the index toward resistance at the 18416 level. Beyond this, the 100-day MA and resistance around the 19000 handle may come back into focus.

Nasdaq 100 Chart, August 5, 2024

Source: TradingView

Support

Resistance

Fact of the Day: Berkshire Hathaway (BRK.B) Have Reduced Their Stake in Apple (AAPL) by 55.8% Since the End of 2023.

Original Post

Read the full article here