Good news included earlier in the week in the Federal Reserve’s (“Fed’) Federal Open Market Committee’s (“FOMC”) July policy statement was followed by a payroll report that landed well below expectations, showing weakened job growth and rising unemployment. Judging by the recent pullback in equity markets, investors may be on the verge of flipping from a “bad news is good news” mindset to a “bad news is bad news” mentality.

On Thursday, equity markets ended the day lower following softer-than-expected economic data. This was fueled in part by the ISM Manufacturing PMI dropping further than expected into contractionary territory. Likewise, construction spending also fell unexpectedly in June. Moreover, in the precursor to today’s release from the Labor Department, jobless claims were reported to have increased by 13,000 more than initially expected.

On the eve of the Labor Department’s monthly release, the Dow Jones Industrial Average (DJIA) dropped about 500 points, while the Nasdaq Composite (NDX) essentially netted out its big gains logged on Wednesday. Meanwhile, the S&P 500 (SPX) ended the day 1.4% lower, driven in part by an over 20% decline in Moderna (MRNA), which disappointed investors by cutting its sales guidance. A more than 20% decline in shares of Intel (INTC) in the after-hours trading session foreshadowed more bad news for the DJIA on Friday.

Ahead of the Labor Department’s monthly release, the major indexes were still in the red in the pre-market trading hours. Losses then extended following the Labor Department’s announcement that just 114,000 jobs were added, drastically below expectations of a 185,000 increase. This came as yields on 10-Year Treasuries fell further to 3.847% from 3.977% on Thursday.

Earlier in the week, the FOMC placed greater emphasis on their attentiveness to both sides of their dual mandate as opposed to a more myopic view on inflation. Today’s jobs report showing a drastic slowdown in hiring and rising unemployment validates this viewpoint. Here’s what else you need to know about the July jobs report.

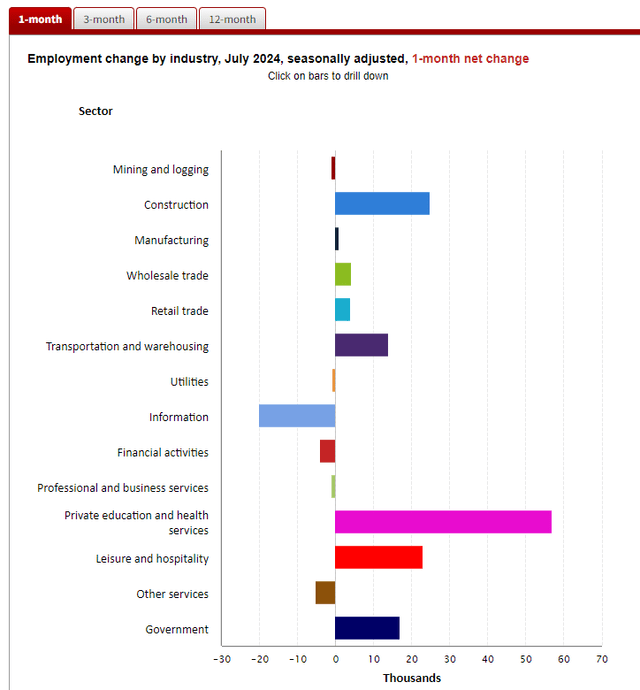

What Sectors Added Jobs In July?

Job gains in July were concentrated in the health care and construction sectors, with the two adding a combined 80,000 jobs. While the gains in construction marked a continued trend higher in recent months, health care gains were below its average over the prior 12 months.

Further moderation in this sector in the coming months may likely weigh on future readings. The pullback in hiring in health care also coincides with more muted gains in government employment. The sector added just 17,000 jobs in July, well below the 70,000 gains logged in the month prior. Weakness here is one of the primary reasons overall growth in July landed below the mark.

BLS – Employment Change By Industry in July

Employment was muted elsewhere as well, with social assistance adding 9,000 or 14,000 below its average gains over the last twelve months. The transportation and warehousing sectors did add 14,000 jobs during the month. However, the gains were partially offset by job losses of 11,000 in ground passenger transportation.

July’s muted reading is a stark contrast to the gains reported in prior months. It’s worth noting, too, that the prior two months of data were revised down by a combined 29,000. The slowing growth seems to validate the heightened awareness of the labor market exhibited in the Fed’s most recent policy meeting.

July Unemployment Rate And Wage Growth

One of the most closely watched metrics in July was the unemployment rate. The rise in unemployment in recent months has sparked discussions about a recession predictor called the “Sahm Rule.” According to this rule, the economy is considered to be in a recession when the three-month average unemployment rate rises ½% above its 12-month low. With the unemployment rate holding steady at 4.1% over the past two months, a reading of 4.2% would have met this recession threshold.

It clearly didn’t sit well with equity investors, then, when the unemployment rate was reported at 4.3%, above the 4.1% expected and more importantly, above the 4.2% Sahm threshold.

The unemployment data likely overshadowed the more positive news on wage growth. In July, earnings increased by 0.3%, less than expected. Annually, this equated to a 3.6% YOY rise, also less than expected. Factors such as rising joblessness, lower quit rates, and a generally softer labor market are likely contributing to the more moderate growth observed in recent months.

Fed Rate Implications

At the conclusion of the two-day FOMC July policy meeting, Jerome Powell stated to observers that “a reduction in the policy rate could be on the table as soon as the next meeting in September.” The Fed Chairman couldn’t have been clearer in signaling his intentions.

This statement was preceded by a policy statement that included significant revisions to key passages, most notably the update that the committee is “attentive to the risks to both sides of its dual mandate.” This marked a departure from the previous focus purely on inflation risks, suggesting that policymakers are increasingly concerned about softening conditions in the labor market.

The dovish policy statement and Powell’s commentary significantly increased the likelihood of a rate cut at the Fed’s next meeting in September. According to the CME FedWatch Tool, a rate cut in September was nearly certain heading into today’s payroll report, with additional reductions anticipated in November and December.

CME FedWatch Tool – Target Rate Probabilities For September FOMC Meeting

In light of today’s report, it would be reasonable to question whether the Fed is waiting too long to cut rates and is jeopardizing their chances of engineering a “soft landing”. In my view, I don’t believe one bad jobs report is sufficient to make that conclusion. However, I do believe the softer-than-expected reading does increase the chances of additional rate cuts in the final two months of the year.

Final Takeaway From The July Jobs Report

In their July policy statement, the FOMC notably highlighted the risks to both sides of its dual mandate, moving beyond the singular focus on inflation and suggesting instead heightened awareness of labor conditions. In my view, July’s payroll report validates the Federal Reserve’s heightened attention to the softening labor market.

Payroll growth not only significantly missed expectations, but the unemployment rate also rose above a critical psychological threshold indicated by the Sahm rule, historically, a reliable recession indicator. This uptick in unemployment likely holds more significance than the missed payroll targets, especially since the muted job growth was primarily sector-specific, with the government sector adding 53,000 less jobs compared to June.

The more pronounced slowing in the labor market may lead to concerns that the Fed might be delaying policy rate easing for too long. While I don’t necessarily agree with this view, I do believe that the odds of additional rate reductions in the final two months are possible.

Ultimately, today’s payroll data supports the view that the Fed remains on track for a rate reduction in September. Although the higher probabilities of a rate cut have buoyed equities in recent weeks, the recent weakness in equities over the last two days suggests a shift towards a more cautious market stance. This “risk-off” mode indicates a preference for safer investments in response to softening economic activity. With the impacts of rate cuts largely priced in, it wouldn’t be surprising to see more investors moving to the sidelines in the months ahead.

Read the full article here