Investment Thesis

Vertiv Holdings Co (NYSE:VRT) — this cooling company’s stock is running red-hot. In fact, beyond its piping-hot rhetoric, its fundamentals are not quite keeping up.

Case in point, its book-to-bill ratio has dropped back down to 1.4x from 1.5x in the prior quarter and is moving in the opposite to where I believe demand is going.

What’s more, if we make some fair assumptions of its free cash flow profile next year, this stock is being priced at 33x next year’s free cash flow. And I’m not sure that this is so attractive, particularly for a company that’s growing in the sub-20s% CAGR.

Altogether, I’m now revising my rating to a hold.

Rapid Recap

In my previous analysis, I said,

Vertiv is a compelling buy due to its strong market positioning in the rapidly growing data center industry and its impressive financial performance.

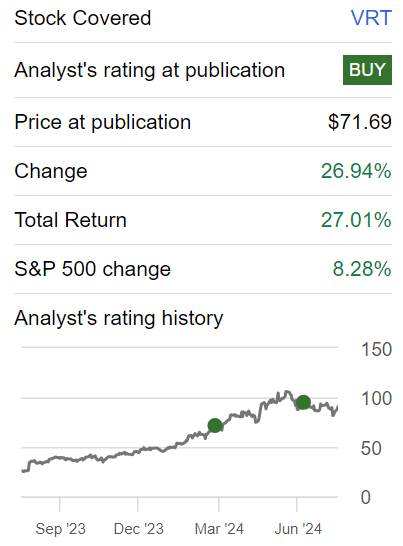

Author’s work on VRT

This is a stock that I’ve been bullish on for some time. However, I’m now less bullish than I’ve been for a while. Here why.

Why Vertiv? Why Now?

Vertiv provides essential infrastructure solutions for data centers, focusing on advanced technology to manage power and cooling.

Their products, like liquid cooling and power distribution systems, are crucial for modern data centers, especially as the demand in the Americas grows.

Vertiv’s strategic investments aim to meet the increasing need for these solutions, driven by the rise of AI.

Indeed, its narrative revolves around Vertiv’s comprehensive portfolio and a global team of engineers, that allows Vertiv to connect IT to facilities, ensuring efficient operation in the complex data center environment.

What’s more, as an investor who categorically recognizes the need for more energy to service the cooling of data centers, I simply don’t believe the thesis that this is the best vehicle for investors seeking exposure to this idea overall concept.

Even if you are long, consider more than just its narrative, let’s discuss Vertiv’s fundamentals.

Revenue Growth Rates Should Improve in 2025, And Yet

VRT revenue growth rates

Vertiv upwards revised its revenue guidance by $50 million to just over $7.7 billion. This is the second time so far that Vertiv has raised its total revenue guidance this year. And yet, for an incredibly well-positioned company, in perhaps, excuse the pun, the hottest area of the market, its growth rates are not delivering the sort of growth that aligns with its narrative.

More concretely, its book-to-bill ratio actually dropped from 1.5x in Q1 2024 to 1.4x in Q2 2024. Again, this does not tally up with my expectations for Vertiv. Rather than forcing my thesis into the stock, I prefer to step back and reassess my bullish view of this stock, particularly when we take hold of its valuation.

VRT Stock Valuation — 33x Next Year’s Free Cash Flow

In my previous analysis, I declared,

Vertiv’s leverage presently stands at 2.2x. This is not backbreaking, but it does restrict the company to a certain extent. Of that, there’s no denying. Management attempts to assuage investors’ concerns that starting Q3 2024, its leverage will retrace back down to approximately 2x, but the fact remains, that there’s still quite a lot of debt to chop through, and this is one aspect that stops me from being more bullish on Vertiv.

Another 90 days have now passed. And Vertiv’s leverage has now dropped to a more manageable 1.8x. I won’t go as far as to contend that this is no longer a problem for Vertiv’s financial standing, as indeed Vertiv’s growth rates are not sufficiently high for this debt profile. Nonetheless, it’s clear that management’s focus on improving its leverage profile has been rewarded.

All that being said, it will still be quite some time until Vertiv is in a position to increase its capital returning to shareholders.

On the other hand, together with its Q2 2024 results, Vertiv upwards revised its free cash flow guidance by $50 million towards $900 million of free cash flow at the high end of its estimate.

Now, if we presume that Vertiv’s free cash flow increases by a further 15% in 2025, this would put Vertiv’s free cash flow on a path towards just over $1 billion in free cash flow in 2025.

In a market full of recently opened-up opportunities, I’m not fully convinced that Vertiv is all that compelling.

The Bottom Line

Considering Vertiv’s valuation at 33x next year’s free cash flow, I believe this stock is fairly priced.

Despite the company’s strong positioning and essential infrastructure solutions for data centers, the fundamentals, such as the declining book-to-bill ratio and sub-20% CAGR growth, don’t fully support the high valuation, at least for me.

Furthermore, the company’s debt profile and moderate revenue growth further suggest a fairly valued stock.

Therefore, while Vertiv Holdings Co remains a crucial player in the data center industry, paying a premium for its stock at this level feels like a stretch. Vertiv might be a “cool” company, but its current valuation is too hot for me.

Read the full article here