Intel Corporation (NASDAQ:INTC) has been doing quite poorly in terms of earnings and sales for many years now. This is certainly reflected in the stock price. In fact, INTC stock is trading at multi-year lows. Yet, the company invests heavily in AI and is a sound competitor to Nvidia (NVDA). The company is expected to report its 2Q earnings on 1 August. I will discuss the expected earnings.

This is my first article on Intel. However, I have previously written about Nvidia, its competitors, including Intel, and NVDA stock’s ridiculous valuations. In my most recent article on Nvidia and its rivals, I wrote that Intel and Advanced Micro Devices (AMD) were serious threats to Nvidia. Although NVDA stock price has risen since then, the competition risk remains. Let me analyze Intel to see if it is worth buying now.

Intel Corporation’s results

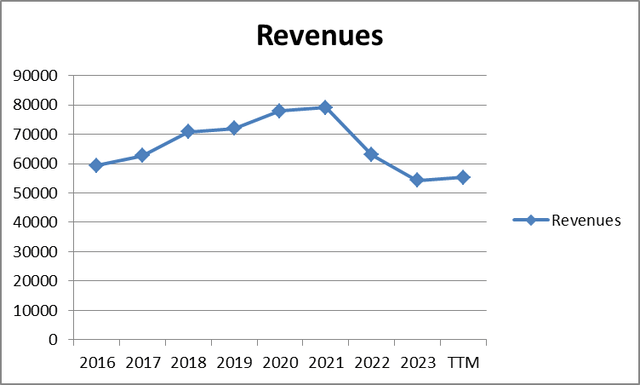

Intel Corporation has been reporting rather disappointing results for a while. As you can see from the tables and graphs below, sales and net profits have reached their lows in 2023.

Intel Corporation’s annual sales and profits

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | TTM | |

| Revenues | 59387 | 62761 | 70848 | 71965 | 77867 | 79024 | 63054 | 54228 | 55237 |

| Net income | 10316 | 9601 | 21053 | 21048 | 20899 | 19868 | 8014 | 1689 | 4066 |

Source: Prepared by the author based on Seeking Alpha’s data.

Prepared by the author based on Seeking Alpha’s data

Prepared by the author based on Seeking Alpha’s data

This is true. However, we can clearly see that trailing twelve-month (TTM) results, both net profits and sales, seem to be somewhat better compared to the ones recorded in 2023.

We can see a very similar picture if we take a look at the company’s quarterly earnings and revenues. Let us compare the first quarter of 2024 to the first quarter of 2023. We can see there was a clear improvement. The net loss decreased while the sales increased.

| Apr 2022 | Jul 2022 | Oct 2023 | Dec 2022 | Apr 2023 | Jul 2023 | Sep 2023 | Dec 2023 | Mar 2024 | |

| Revenues | 18353 | 15321 | 15338 | 14042 | 11715 | 12949 | 14158 | 15406 | 12724 |

| Net income | 8113 | -454 | 1019 | -664 | -2758 | 1481 | 297 | 2669 | -381 |

Source: Prepared by the author based on Seeking Alpha’s data.

Prepared by the author based on Seeking Alpha’s data

Prepared by the author based on Seeking Alpha’s data

The results for the last two quarters were strong compared to 4Q 2022 and 1Q 2023 and, therefore, made the TTM data look better compared to 2023.

Intel.com

Why is that, then? That is because the Intel products and Intel foundry segments’ revenues were rising in 2023. 4Q 2023 was the best period last year for most of the segments.

However, Intel’s stock price decreased upon its latest quarterly report because revenues were short of estimates. The revenues and earnings were worse compared to 4Q 2023. The company also provided a not-so-strong forecast for the current quarter.

However, the results were still better compared to the same period a year ago. The strongest revenue rise was due to Mobileye, 48% YoY. But all of Intel’s departments reported better results YoY.

Intel

Intel’s 2Q 2024 earnings

Yahoo Finance

As I have mentioned above, the company will report its quarterly earnings on 1 August.

According to analysts’ estimates, the current second quarter’s earnings will total 10 cents per share. This is substantially less than September’s estimated earnings of 32 cents per share.

Seeking Alpha

But if analysts are right in their estimates, the EPS for the current quarter will rather be mediocre, neither particularly high nor negative. As I have mentioned above, Intel’s March 2024 quarter earnings totaled ($0.09) per share, while for the December 2023 quarter these totaled $0.62.

Yahoo Finance

However, Intel’s sales are expected to increase. The average sales estimate is $12.97 billion, a rise from the March 2024 result of $12.724 billion.

Seeking Alpha

But I would not only focus on the reported revenue and earnings figures, but instead watch the management’s conference, during which the business strategy updates will be discussed. In my view, the most important upside factor for Intel is its foundry. So, it is critical to watch for the news on that front. I will discuss this in the next section.

Intel’s upside factors

Nvidia Corporation has been leading the AI chip race. But it is not a monopolist, certainly. After more than one unsuccessful attempt to enter the GPU market, Intel, the largest company producing PC and server CPUs, now seems to be close to becoming a large player in this field.

According to PassMark Software, Intel’s share of the x86 CPU market is equivalent to 64%. Unfortunately, it has given AMD a lot of market share over the years thanks to AMD’s cheaper and more advanced CPUs. Intel’s CPUs were not small, dense, and power-efficient enough.

Despite the not-so-brilliant but improving last set of quarterly results, the Gaudi 3 release is expected to bring in more than $500 million in revenues during the second half of the year. Intel also differentiates itself from AMD and Nvidia with lower prices.

It is also betting big on becoming the leader in the foundry market. To achieve that, the company plans to open chip fabs throughout the US, which is an expensive move because Intel does not expect to break even on this front before 2027. But it could eventually become a good chance for the company. The idea to become a leading semiconductor foundry is part of CEO Pat Gelsinger’s IDM 2.0 plan. The plan was announced when Pat Gelsinger became Intel’s CEO in 2021.

According to Mr. Gelsinger, the IDM (Integrated Device Manufacturer, the term for semiconductor companies that both design and manufacture chips) 2.0 plan involved three key components, namely: 1) expanding Intel’s manufacturing capacities with industry-leading process technologies, 2) expanding the use of third-party foundry capacities to meet Intel’s needs, and 3) becoming one of the leading foundries with the aim of being the number two foundry by 2030. These aims were to deliver five new process nodes in four years’ time. This would regain Intel’s leadership, while expanding fab capacity at an estimated budget of $100 billion through expanding existing fabs and building six new fabs in Arizona, Ohio, and Germany. Well, these goals seem to be ambitious and require money above and beyond anything the industry has ever seen before.

To become a foundry player, Intel’s business strategy has to change. Both Samsung (OTCPK:SSNLF) and GlobalFoundries (GFS) have made this transition, but with some problems. GlobalFoundries is now a pure foundry, similar to Taiwan Semiconductor Manufacturing Company Limited aka TSMC (TSM), while Samsung manufactures products and provides foundry services, similar to what Intel is doing. Intel attempted to provide foundry services before, but was unable to compete. Intel did not want to modify its manufacturing process for every single product, a necessary condition to deliver an optimized product, which is particularly important for cost- and power-sensitive applications like mobile devices. So, to succeed, Intel had to start thinking and behaving like a pure foundry.

Investing in semiconductor manufacturing is expensive. It requires a constant investment in new manufacturing process technology, and also a continued investment in new manufacturing capacity. Both types of costs have been rising substantially over the history of the semiconductor industry. Sure, if everything goes as planned, Intel will become the leading foundry in 2030, which will mean much higher revenues and earnings than the company is experiencing now. But as I have mentioned before, this requires very high capital expenditures, and the result will only be seen in several years’ time.

But the company is already doing all it can to progress in the field. Intel’s foundry officially opened in February this year, but its two foundries in Arizona and a pair in Ohio appear to have been delayed. They are expected to come online later this year or early in 2025. According to recent reports, the Arizona two fabs as well as upgrades to Intel’s existing Ocotillo plant, will cost almost $32 billion. The Ohio fabs were predicted to cost almost $10 billion. But as of early 2024, the estimate is about $28 billion.

The new fab sites are not only limited to the ones based in the US. Construction of new fabs was announced in Germany and Israel. Detailed assembly, test, and packaging facilities are under development in Malaysia and planned for Poland.

One of the largest fabs is the one in Magdeburg, Germany. It was announced at the beginning of 2022 as part of a €33 billion ($35.1 billion) manufacturing plan across Europe, of which the German plant would account for about €17 billion. It was expected the plant would break ground in early-to-mid 2023 and start manufacturing components as early as 2027. However, the fab plant started having problems.

Despite the fact not all of its projects go as planned, Intel still hopes to beat Samsung as the world’s second-largest foundry next year, with its manufacturing revenue of more than $20 billion. Market leader TSMC’s estimated 2024 revenue is $85 billion.

If Intel catches up with TSMC and Samsung, it will get contracts to build high-performance chips from clients like Apple (AAPL), Nvidia (NVDA) and Qualcomm (QCOM). These companies do not run their production facilities and contract for Taiwanese and Korean firms to make chips of their design.

Despite the fact some of Intel’s projects do not go as planned, Intel’s capabilities and the US government’s support of its chip giants might still help Intel achieve its targets. The US government has earmarked almost $30 billion in subsidies for advanced semiconductor production, aiming to bring cutting-edge AI chip development and manufacturing to America.

As concerns Intel’s aims, it wants to maintain its status as a reliable partner in the semiconductor industry. It aims to become a customer-centric business with its foundry to meet the needs of its clients. Intel’s plans to introduce 14A process technology and several specialized node evolutions. These advancements are designed to meet the requirements of AI and other cutting-edge applications, helping Intel to lead the semiconductor industry in innovation and technology.

Intel also aims to become the leading AI chip manufacturer. So, it launched new AI accelerators this year and started expanding its manufacturing capacities. The launch of Gaudi 2 and Gaudi 3 accelerators, capable of running AI workloads for data centers, will highly likely improve the company’s results. Intel is changing its business model, albeit quite slowly.

Intel’s fundamentals

It is quite common to estimate a company’s value by using the discounted cash flow (DCF) model. However, it is quite difficult to do so in the case of Intel because it is difficult to predict both its future earnings and cash flows. As I have mentioned above, its earnings have been falling for a while, while it may take the positive factors lots of time to translate into cash. But let us take a look at its debt and liquidity indicators.

|

Indicator |

Value |

|

Debt-to-Equity ratio |

81,977/105,973=0,77 |

|

Current ratio |

42,608/27,213=1,57 |

|

Interest coverage ratio (EBT/interest expense) |

762/872=0,87 |

Source: Prepared by the author based on Seeking Alpha’s data.

Intel’s debt ratios show us quite a mixed picture. The debt-to-equity ratio shows us that the company’s total liabilities are lower than its shareholders’ equity, which is a piece of good news for Intel’s investors. The current ratio is also reasonable, since it shows that Intel’s current assets are more than 1.5 times greater than its current liabilities. Many analysts consider a ratio between 1.2 and 2 to be normal. However, the most worrying indicator is the interest coverage ratio. The company’s 2023 earnings before tax were even lower than its interest expense.

As concerns Intel’s profitability figures, its net profit margin is higher than some of its peers’. For example, Micron Technology’s (MU) and Marvell Technology’s (MRVL) net profit margins are negative. Analog Devices (ADI) and Texas Instruments (TXN), meanwhile, have net profit margins of 20.45% and 35.16%, respectively. So, Intel net profit margin is rather average.

Seeking Alpha

As concerns Nvidia, one of Intel’s close competitors, its profit margins are much higher. Nvidia’s net profit margin is a whopping 53.40%.

Seeking Alpha

In my previous article on Nvidia, I also wrote about the company’s debt and liquidity indicators.

|

Indicator |

Value |

|

Debt-to-Equity ratio |

27930/49142=0,57 |

|

Current ratio |

53729/15223=3,53 |

|

Interest coverage ratio (EBIT/interest expense) |

47741/255=187 |

Source: Borrowed from the author’s other Seeking Alpha article.

In short, Nvidia’s indicators are much better than Intel’s. This is especially true of Nvidia’s interest coverage ratio, which is a whopping 187. But as I wrote in my previous article, Nvidia’s valuations were sky-high. Now, let us take a look at Intel’s valuations.

INTC valuation

It is true that Intel is not as profitable as many investors would like it to be. However, Intel is also cheaper than most of its competitors, MU, Analog Devices (ADI), Texas Instruments (TXN) and MRVL in terms of profitability ratios, P/S, P/B and EV/EBITDA.

Seeking Alpha

But the most expensive competitor is arguably Nvidia. Its profitability, P/S, P/B and price-to-free cash flow ratios are all much higher than those of INTC.

Seeking Alpha

This is explainable, indeed. Intel is not as profitable and cash-rich as Nvidia. Still, Intel is also cheap compared to its other competitors, as illustrated by the table above. But let us take a look at Intel’s valuation ratio histories.

First, the company’s P/E ratio is not near its all-time highs but not as low as it was before 2023.

The price-to-sales ratio is also quite average compared to the highs recorded in 2018 and 2020.

As concerns Intel’s P/B ratio, it is near multi-year lows.

All this means INTC stock is cheap relative to its peers and also to its history.

Risks

The risks are obvious. To start with, Intel has been reporting falling sales and earnings for a while. It does not have as brilliant cash holdings and a debt position as Nvidia. The competition with AMD and Nvidia is also fierce. Moreover, general risks, including a recession and deteriorating US-China relations also apply because Intel operates in the semiconductor chips industry. So, as you can see, there are serious downside risks. However, all these risks seem to be already factored into the current stock price.

Conclusion

I fully appreciate that it feels very rewarding to be invested in Nvidia’s phenomenal sales, earnings growth and surging stock price. Buying INTC appears quite a risky buy, given its earnings track record and its not-so-brilliant financial position. But there is still a probability that the company might do much better if it wins a substantial market share in the AI market. Its recent innovations might lead to substantial progress, but only in several years’ time. Thus, I would not buy Intel Corporation stock or sell INTC short, but instead remain neutral on the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here