Synopsis

Howmet (NYSE:HWM) specialises in supplying advanced engineered solutions for the aerospace and transportation industries. HWM’s historical financials have shown consistent top-line growth. In addition to that, its profitability margins remained robust over the same time period. For its most recent 1Q24, HWM’s continued to report revenue growth, which was up 14% year-over-year. The main driver was the strong growth in the commercial aerospace market.

According to the International Civil Aviation Organisation’s data, current passenger air traffic has already surpassed pre-COVID levels. It is forecast that air traffic demand in 2024 will be 3% higher than in 2019. Additionally, aircraft deliveries are also forecast to increase in 2024 and are expected to continue growing in 2025. According to Airbus, it is forecast that total demand for new aircraft will reach approximately 40,850 by 2042. Given the positive outlook, I am recommending a buy rating for HWM.

Historical Financial Analysis

Author’s Chart

Over the last three years, HWM’s top line has shown robust and consistent growth. In 2023, sales increased to approximately $6.64 billion, up 17% from 2022’s approximately $5.663 billion. This double-digit growth was attributed to higher sales in all four markets, which are commercial aerospace, defence aerospace, commercial transportation, and industrial and other markets. Additionally, favourable product pricing and an increase in material cost pass through also contributed to the sales growth.

Author’s Chart

Moving onto HWM’s profitability margins, both its adjusted EBITDA margin excluding special items and net income margin excluding special items performed well over the past three years.

In 2023, HWM’s full year adjusted EBITDA excluding special items increased 18% to approximately $1.5 billion. This 18% growth was attributed to the increased volume in the commercial aerospace market. As a result, its adjusted EBITDA margin excluding special items expanded from 22.5% to 22.7%. However, if we excluded the inflationary cost pass through, the adjusted EBITDA margin excluding special items would have been higher at 23%.

HWM’s net income margin excluding special items has also been consistently expanding over the same three-year period. In 2023, HWM’s net income margin excluding special items expanded from 10.5% to 11.5%. The net income margin expansion is driven by the improvement in HWM’s operating income margin, which expanded from 16.2% to 18.1%.

First Quarter 2024 Earnings Analysis

For the quarter, HWM’s revenue increased 14% year-over-year to $1.82 billion. This double-digit percentage growth was attributed to favourable product pricing and increased volumes from the commercial aerospace, defence aerospace, and industrial and other markets. The main driver of this growth was the commercial aerospace market, which grew by 23%.

HWM’s reportable segments are engine products, fastening systems, engineered structures, and forged wheels. For the quarter, three out of the four segments reported year-over-year growth. Its engine products segment increased 11% year over year, driven by robust commercial aerospace, defence aerospace, and oil and gas markets’ growth. Its fastening systems grew 25% year-over-year, and it was driven by commercial aerospace. Its engineered structures increased 27% year-over-year, driven by the commercial aerospace and defence aerospace markets.

On the other hand, its forged wheels 1Q24’s revenue was flat year-over-year. Revenue was flat because the 2% higher volume was completely offset by the drop in the price of aluminium and other inflationary costs pass through.

Author’s Chart

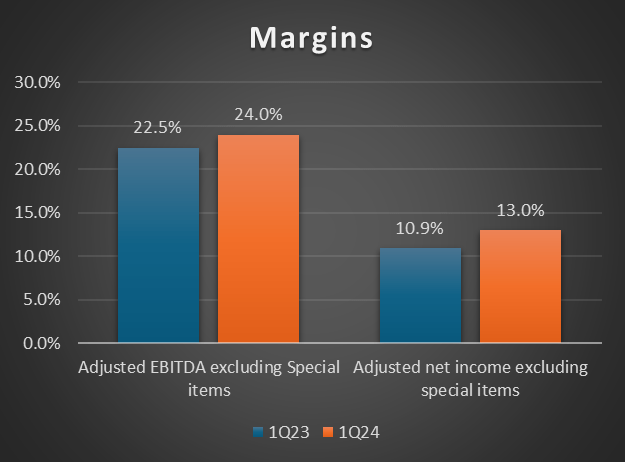

Moving onto HWM’s 1Q24 profitability margins, both adjusted margins performed well year-over-year. Its adjusted EBITDA excluding special items increased 21% year-over-year. This strong growth was attributed to volume growth in the commercial aerospace market. As a result, its adjusted EBITDA margin excluding special items expanded from 22.5% to 24%.

On the other hand, its adjusted net income excluding special items for 1Q24 was approximately $238 million, which also translates into $0.57 per share. For context, the previous period’s adjusted net income excluding special items was $175 million, or $0.42 per share. This implies that its adjusted net income excluding special items grew approximately 36% year-over-year. Its adjusted net income margin excluding special items expanded from 10.9% to 13%.

Business Overview

Investor Relations

HWM’s end market can be segregated into four areas, which are commercial aerospace, defence aerospace, commercial transportation, and industrial and others. Among these segments, commercial aerospace forms the largest share of HWM’s total sales, accounting for approximately 51%. Coming in second is the commercial transportation segment, which accounts for 19%. Its defence aerospace and industrial and other segments account for 15% each.

Passenger Air Traffic

According to the International Civil Aviation Organisation [ICAO], air traffic demand for 2024 is forecast to be 3% higher than in 2019. Air traffic demand has the potential to increase by 4% if the rate of recovery picks up momentum on the routes where pre-pandemic levels have not yet been achieved.

International Civil Aviation Organisation

Revenue passenger kilometres [RPK] is a metric used to measure total demand, while available seat kilometres [ASK] is used to measure total capacity. Looking at the chart, 2024’s RPK has already surpassed 2019’s levels, or pre-COVID levels. Furthermore, 2024 levels are also higher than 2023, highlighted in pink.

Compared to May 2019, May 2024’s RPK was up 5.7%. For June and July 2024, ICAO forecast RPK to continue growing at a rate of about 2.3% and 5.9% month-over-month, respectively. Currently, air travel demand is robust and is expected to remain robust. This positive outlook is supporting record aircraft OEM backlogs.

Aircraft Deliveries

Accenture

According to Accenture, it is forecast that both Airbus and Boeing will deliver roughly 1,400 commercial aircraft in 2024. This figure is higher than what they delivered in 2023, which was 1,262 aircraft. For 2025, total aircraft deliveries, which include both wide and narrow bodies, are expected to continue growing.

Based on Airbus’s data, in 2020, there were about 22,880 aircraft worldwide, and the total number of aircraft is expected to expand to roughly 46,560. Out of the 22,880, 25% are expected to remain in service, which translates to approximately 5,710 aircraft. The remaining 17,170 aircraft will be replaced. 23,680 is attributed to growth and expansion. In total, Airbus forecasts that the total demand for new aircraft will be approximately 40,850. Looking ahead, the outlook for aircraft demand is positive.

Airbus

Boeing

On May 31, 2024, the Federal Aviation Administration [FAA] did not allow Boeing to increase its 737 MAX production in order to address the ongoing safety concerns. Previously, the FAA imposed a production cap of 38 Boeing 737 MAX aircraft per month due to an incident in Portland.

Just a month ago, Boeing reported delivering 24 planes in May, which is half of what it delivered last May. The reason behind the decline was because Boeing was running a slower assembly line.

Due to the unfavourable results reported by Boeing, HWM is cutting back its estimates for Boeing to an average production rate of approximately 20 aircraft per month in 2024. Therefore, in the short term, I anticipate that the challenges faced by Boeing will create headwinds for HWM. However, in the longer term, once the FAA restriction is lifted and Boeing is able to overcome the challenges it currently faces, it will benefit HWM once its deliveries increase.

Relative Valuation Model

Author’s Relative Valuation Model

According to Seeking Alpha, HWM operates in the aerospace and defence industries. In my relative valuation model, I will be comparing HWM against its peers in terms of growth outlook and profitability margin trailing twelve months [TTM]. For growth outlook, I will be comparing their forward revenue growth rate, which is a forward-looking metric. For profitability margins TTM, I will be comparing their EBITDA margin TTM and net income margin TTM. These metrics give us a gauge of their core business activities’ performance and how they stack against each other.

In terms of growth outlook, HWM outperformed its peers as it has a forward revenue growth rate of 12.28%, which is higher than peers’ median of 11.72%. However, when it comes to profitability margins TTM, this is where HWM shines. HWM outperformed its peers in both EBITDA margin TTM and net income margin TTM. HWM’s reported EBITDA margin TTM of 22.36% is significantly higher than its peers’ median of 12.64%, which represents 1.77x over the peers’ median. For net income margin TTM, HWM reported 12.53%, while its peers’ median is 9.39%.

Currently, HWM’s forward non-GAAP P/E ratio is 33.53x, higher than peers’ median of 28.97x. Given HWM’s outperformance in growth outlook and profitability margins, it is fair for HWM to have a higher P/E ratio. The higher P/E ratio reflects the strength and robustness of HWM’s business. However, in order to remain conservative in my valuation approach, I will be adjusting my 2025 target P/E for HWM downward to 31x.

For 2024, the market revenue estimate for HWM is approximately $7.33 billion, while EPS is $2.39. For 2025, the market revenue estimate is approximately $8.02 billion, while EPS is $2.88.

When analysing its 1Q24 earnings release, HWM did provide its guidance for full year 2024. For revenue, HWM guided it to be between $7.225 billion and $7.375 billion. At the midpoint, it is approximately $7.3 billion. For adjusted EPS, it is guided to be between $2.31 and $2.39. Free cash flow is forecast to be between $750 million and $850 million. Together, the management’s guidance and my forward-looking analysis as discussed support and justify the market’s estimation. Therefore, by applying my 2025 target P/E to its 2025 EPS estimate, my 2025 target price for HWM is approximately $89.28.

Risk and Conclusion

The risk associated with HWM is its dependency on a limited number of suppliers for materials that are crucial to its business operations. Currently, it gets its materials and services, including raw materials, from a limited number of suppliers. For raw materials such as titanium sponge and specialised metal alloys, HWM depends on a limited number of source or sole source suppliers.

Although it has annual or long-term contracts for most supply requirements, the remainder is dependent on spot purchases. As in the case of most contracts, there is no guarantee of renewing them on favourable terms or at all. In addition, HWM might be forced to buy materials and supplies from other sources, which might not be available in sufficient quantities or at prices that are advantageous to them, if any of its suppliers experience difficulties and are unable to deliver.

HWM’s past financial results have shown strong top-line growth driven by all four of its end markets. Additionally, its profit margins remained robust as well. For 1Q24, it reported strong revenue growth of 14% year-over-year, driven mainly by the commercial aerospace market, which grew by 23%.

According to the ICAO, air traffic demand for 2024 is forecast to be 3% higher than in 2019. The current RPK has already surpassed both 2023 and pre-COVID levels. In addition, aircraft deliveries for both wide and narrow bodies are forecast to increase in 2024 and 2025. Furthermore, Airbus forecasts that the total demand for new aircraft will be approximately 40,850 in 2042. Given the positive outlook, I am recommending a buy rating for HWM.

Read the full article here