BKNG’s Investment Thesis Remains Robust Here – Thanks To The Secular Travel Trends

We previously covered Booking Holdings (NASDAQ:BKNG) in September 2023, discussing why we had rated the stock as a Buy despite the short-term headwinds during the pandemic and the inherent cyclical nature of the travel industry.

With the platform “responsible for 25% of all hotel bookings worldwide,” while continuing to report robust performance in the alternative accommodation segment and growing its profitability, we had believed that the Online Travel Agent [OTA] continued to offer a compelling investment thesis then.

Since then, BKNG has generated a +24.1% stock return, nearly in line with the wider market at +24.5% over the same time period.

At the same time, it continues to deliver consecutive double beat earning performances, well exceeding expectations while outperforming its direct OTA peer, Expedia (NASDAQ:EXPE).

We will also highlight a few metrics to look out for in the upcoming FQ2’24 earnings call on August 01, 2024, with these underscoring the health of BKNG’s businesses and near-term prospects.

1. Connected Trip Vision

Genius Loyalty Program

Booking

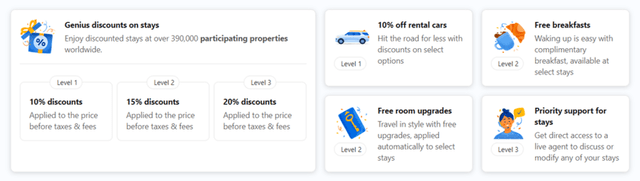

BKNG had previously launched their Genius Loyalty Program in 2016, in the hopes of “delivering more value for our customers and partners” while tapping into corporate travel, which at that time, comprised 20% of its hotel reservations.

While the management has yet to “give away numbers in our Genius membership,” it is apparent that the loyalty program has been rather successful, with it playing “an increasingly important role in the multiple elements of travel that we offer” and triggering an “encouraging behavior from our Genius-level 2 and 3 travelers including higher frequency and a higher rate of direct booking than what we see for our overall business.”

With increased loyalty and more repeat customers, it is unsurprising that BKNG has reported a growing mix of direct bookings across its well diversified offerings, including hotels, vacation homes/ alternative stays, flights, rental cars, and attraction bookings, amongst others.

This trend has been observed in the accelerating FY2023 Merchant Revenues of $10.93B (+52% YoY/ +185.3% from FY2019 levels of $3.83B) and FQ1’24 at $2.38B (-3.6% QoQ/ +36% YoY), comprising 51.1% (+9.1 points YoY/ +25.7 from FY2019 levels of 25.4%) and 53.9% of its overall revenues (+2.3 points QoQ/ +7.5 YoY), respectively.

On the other hand, it is apparent that these efforts have incurred more “merchant-related expenses,” as observed in BKNG’s deteriorating EBITDA margins of 33.3% in FY2023 (+2.3 points YoY/ -5.6 from FY2019 levels of 38.9%) and 20.3% in FQ1’24 (-10.3 points QoQ/ +4.8 YoY).

The same has been observed in its mixed Free Cash Flow margins of 32.8% in FY2023 (-3.4 points YoY/ +3 from FY2019 levels of 29.8%) and 58.3% in FQ1’24 (+31.2 points QoQ/ -15.8 YoY).

Therefore, while these “connected transactions have increased by just over +50% YoY” and delivered higher gross bookings in FQ1’24, readers may want to pay attention to BKNG’s profit margins in the upcoming FQ2’24 earnings call.

This is especially since the growth efforts may be a net negative on its bottom lines, as the management guides the expansion of its Genius Loyalty Program to include all of its travel offerings from 2024 onwards.

2. Personalized Experience Through AI Technology – Robust Travel Trends

At the same time, BKNG has been leveraging its in-house AI capabilities to enhance the Genius Loyalty Program since 2017, with it delivering improved customer experience through the personalized trip planner.

Combined with the new LLM powered by OpenAI’s ChatGPT since June 2023, it is unsurprising that the travel booking platform has reported higher brand loyalty, as discussed in the section above.

At the same time, based on the improved brand loyalty and growing members, we believe that BKNG may be able to leverage its proprietary data while fine-tuning its AI-powered travel assistant and advertising capabilities.

For example, the OTA has already reported expanding advertising revenues of $1.01B in FY2023 (+13.5% YoY) and $264M in FQ1’24 (+6.8% QoQ/ +8.1% YoY), with the management already highlighting increased monetization opportunities and the advertising segment expected to “the biggest driver of our EBITDA margin expansion” in FY2024.

BKNG’s Robust Performance Metrics & Peer Comparison

BKNG & Business Of Apps

These efforts have naturally led to BKNG’s faster recovery rebound after the pandemic, as observed in the performance metric on the image above (left) and robust revenue growth compared to its OTA peers on the image above (right), aside from Airbnb (ABNB).

Even so, BKNG continues to intensify their efforts to appeal to customers seeking alternative accommodations, with the segment already comprising 36% of its global room nights in FQ1’24 (+4 points QoQ/ +3 YoY), implying the OTA platform’s growing mindshare amongst global travelers.

More partners are also signing on its platform, as observed in the increased global alternative accommodation listings at 7.4M (+11% YoY), further underscoring its ability to steal market share from ABNB.

Global Air Travel Trends & Projections

IATA

Much of BKNG’s tailwinds are also attributed to robust global leisure travel demand, one that has also been observed in cruises, such as Carnival (CCL) and Royal Caribbean Cruises (RCL).

At the same time, global air travel has recovered near to pre-pandemic averages by the end of 2023, with things to further grow over the next few years as the “global commercial aviation fleet also expands by +33% to more than 36,000 aircraft by 2033, according to an Oliver Wyman analysis.”

As a result of these robust tailwinds, we maintain our belief that BKNG remains well positioned to capitalize on the promising travel trends over the next few years, no matter the uncertain macroeconomic outlook.

Perhaps this is why the management has offered an optimistic FY2024 revenue guidance by +7% YoY and adj EPS growth to be above +14% YoY, building upon the robust 4Y top/ bottom-line growth at a CAGR of +9.1% and +10.4%, respectively.

Therefore, while BKNG may have offered a relatively softer Q2 guidance on a QoQ basis, readers must note that much of the headwinds are attributed to FX, ongoing geopolitical events, and the shift in Easter timing (April in 2023 and March in 2024).

As a result, readers may want to temper their expectations in the upcoming earnings call, with the OTA company likely to match or report a small-ish beat on the consensus FQ2’24 revenue estimates of $5.77B (+30.6% QoQ/ +5.6% YoY) and adj EPS of $38.40 (+88.3% QoQ/ +2.1% YoY). Let’s see.

3. BKNG Continues To Trade Attractively Compared To Its Peers

The Consensus Forward Estimates

TIKR Terminal

As a result of the promising FY2024 guidance, it is unsurprising that the consensus has further raised their forward estimates, with the OTA company expected to generate an accelerated top/ bottom line expansion at a CAGR of +8.8%/ +16.2% through FY2026.

This is compared to the previous estimates at +7.9%/ +8.7% and historical growth at +10.3%/ +12.8% between FY2016 and FY2023, respectively.

BKNG Valuations

Seeking Alpha

Despite the massive upgrades, the BKNG stock continues to trade reasonably at FWD P/E of 22.33x as well, near to its 3Y mean of 21x and pre-pandemic mean of 21.12x.

The same reasonable valuation may be observed when comparing to its travel booking platform peers, such as Expedia at FWD P/E of 10.52x and Airbnb at 32.87x.

This is especially after comparing BKNG’s top/ bottom-line growth projections through FY2026 to EXPE’s at +7.2%/ +12.6% and ABNB at +11.8%/ -5.9%, respectively, implying that the former is still attractively valued here while offering interested investors with a decent margin of safety.

So, Is BKNG Stock A Buy, Sell, or Hold?

BKNG 5Y Stock Price

TradingView

For now, the BKNG stock has already charted a new height of $4K by late June 2024, while running away from its 50/ 100/ 200 day moving averages.

For context, we had offered a fair value estimate of $3.17K in our last article, based on its FWD P/E of 21.09x and its annualized FQ2’23 adj EPS of $150.48. This is on top of the long-term price target of $4.24K, based on the consensus FY2025 adj EPS estimates of $201.37.

Based on the management’s FY2024 adj EPS guidance growth of at least +14% YoY to approximately $173.53 and the same FWD P/E valuations of 21x (nearer to its 3Y P/E mean of 21x), it appears that the BKNG stock is trading at a notable premium of +7.4% from our upgraded fair value estimates of $3.64K.

Then again, based on the consensus raised FY2025 adj EPS estimates of $207.01, there remains a decent upside potential of +10.9% to our 2Y price target of $4.34K. Based on the consensus FY2026 adj EPS estimates of $238.82, there is an excellent upside potential of +28.1% to our 3Y price target of $5.01K as well.

While BKNG’s forward dividend yields of 0.89% may appear to be underwhelming compared to the sector median of 2.36% and the US Treasury Yields of between 4.31% and 5.36%, we must remind readers that the annualized pay-outs of $35 per share exemplifies the management’s robust use of cash flow.

This is on top of the sustained share repurchases, with 3.28M or the equivalent 8.6% of its float already retired over the LTM, and 7.51M/ 17.7% since FY2019.

As a result of the robust dual pronged returns through capital returns and dividend incomes, we continue to rate the BKNG stock as a Buy. Do not miss this long-term compounder.

Read the full article here