Investment Thesis

Since my previous bullish article dated February 6th, 2024, Amazon.com, Inc.(NASDAQ:AMZN) has gained 14.30%, outperforming the S&P 500 by a margin of about 4%. In my previous coverage, I had discussed the technical view of the stock, where my points of interest were the support and resistance zones. Currently, the stock is in the resistance zone where it appears to be consolidating a point at which a hold decision is justified as we wait for a clear breakout or a trend reversal.

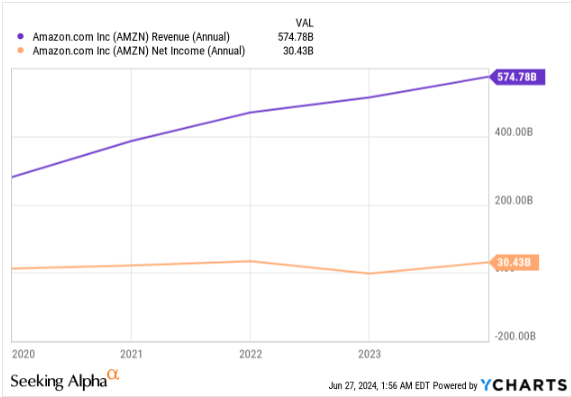

From a fundamental point of view, AMZN has been witnessing an impressive financial performance, with its revenues having grown consistently for more than five years and its profitability having stayed relatively stable despite persistent headwinds such as Covid-19 and the inflationary economy.

YCharts

This strong financial performance has been attributed to its AWS business segment. While this segment has been the company’s growth powerhouse, my assessment of the segment shows a declining marginal impact amid intensifying competition, which could be a concern to investors.

However, the company has changed the management of this powerhouse as well as diversifying to new growth areas, which makes me optimistic about the company’s long-term growth. Based on this background, I believe this stock is a hold as we wait for a clear signal of breakout above the resistance zone.

Technical Analysis: A Potentially New Entry Point In The Horizon

Based on AMZN price movement, the stock has exhibited two major zones. It has a strong support at about $80 and a strong resistance at about $187. Currently, the stock is at the resistance zone whereby it appears to be in a consolidating as shown by the narrow price range shown on the chart below. The price has shown some signs of breaking above the support zone, but the break has been weak, and a clear breakout hasn’t been witnessed, which would mark another upward rally. The previous bullish trajectory which started in March 2020 bounced back at resistance level in July 2021 and went back to the support zone. Since Jan 2023, the stock bounced on the support zone and has been on an upward trajectory, which is currently at the decisional point where a breakout or a reversal is likely.

Trading View

Looking at the oscillators, it appears the market is neutral as shown by the flattening RSI, implying that the stock is indeed in a consolidation phase as shown by the red eclipse.

Market Screener

The MACD is also showing a neutral outlook given that it is almost at the same level as the signal line and the histogram is slightly below the zero mark, a sign of a neutral market outlook at the moment.

Market Screener

This neutral outlook, in my view, is a result of the uncertainty that exists in this major resistance zone, where most investors are waiting for a clear signal of either a breakout or a trend reversal. In my view, the potential of a breakout is very likely given that the MAs are pointing out a long-term bullish trajectory. This is indicated by the price trading above the 50-day, 100-day, and 200-day MAs and also the golden crossover between the 50-day and 200-day MAs which is a sign of a sustainable long-term trajectory.

Market Screener

While I believe the long-term outlook is bullish, my price target is $285.16 which I arrived at by adding the height of the previous bullish trend between the support and resistance zone above the current resistance zone which after a breakout will be the new support zone. However, my short-term outlook is neutral as the stock consolidates before a clear breakout or even a trend reversal, which in my view is less likely because there is no major signal of a reversal. Consequently, I recommend holding the stock until it exhibits a clear break out above the support zone. A good entry point would be at about $200 with the MACD and the RSI showing a bullish outlook.

AWS Bottoming Amid Intensifying Competition?

AMZN has reported consistent sales and profit growth in the most recent quarters. During the MRQ, the company’s net income climbed by about 255% YoY to $47.39 billion, while its net revenue increased by approximately 13% YoY to $143.31 billion. Amazon Web Service [AWS] and its cloud computing business are significant contributors to this excellent achievement. To put things in perspective, AWS accounts for approximately 17% of Amazon’s overall sales but a remarkable 65.7% of the company’s total operating income. AWS reported $90.8 billion in net sales and $24.63 billion in operating income for the fiscal year 2023 – a 13% rise in net sales and a $1.79 billion increase in operating income. The company’s first-quarter 2024 revenues of $25 billion were a YoY rise of 17%, with operational profits of $9.4 billion.

Let’s examine how Amazon’s notable growth accelerator is being impacted by the intensifying competition, even though this is a major driver of growth and an important source of operational income. First and foremost, it’s crucial to recognize that AWS’ YoY growth has been declining since Q2 of 2015, a sign of the increasing competition in the cloud computing space. From Q4 2022 to Q4 2015, the YoY growth rate decreased from 81% to less than 20%. However, beginning Q3 2023, the growth rate has been progressively rising, rising from 13% in Q1 2024 to 17% in Q1 2025.

Statista

It is important to evaluate the competitive landscape that results from this course and contrast Amazon with its two primary competitors, Microsoft and Google. From the standpoint of revenue performance, AWS is not keeping up with its two competitors, as its 17% YoY increase in Q1 2024 is less than Microsoft Azure’s 31% and Google Cloud’s 26% YoY growth. Nonetheless, it seems that Amazon is commanding a higher revenue base; its $25 billion in AWS Q1 2024 revenue is significantly higher than Azure’s $18.8 billion and Google’s $9.6 billion.

This means that although Amazon still dominates this market, its growth trajectory is lower than its competitors and this could be a concern because, in the long run, it could lose a significant market share to its peers. Above all, it’s unfortunate to see what has been a major growth lever for Amazon’s bottom, as shown by the declining YoY growth rate.

Amid this growing competition and decelerating growth, the division has a new leadership, with Matt Garman taking over as the new CEO from his previous position as a leader of sales and marketing. I think he can bring this business line back to life and make it even more competitive given his professional background. Matt has an MBA from Northwestern University and degrees in industrial engineering from Stanford University for both his undergraduate and graduate studies. His commitment to upholding the company’s standing and dependability is reflected in his vision, which highlights security as AWS’s top concern. His association with the segment, which extends back to its inception, puts him in a better position to comprehend and improve the cloud computing business unit.

Garman’s major achievement was his role as AWS’s first product manager, where he was instrumental in building and launching core services that have become fundamental to AWS offerings. An example of a core service that he launched is the Amazon Elastic Compute Cloud (EC2). Among his major duties were to define new features, and establish pricing plans. This foundation work helped set the stage for AWS’s rapid growth and its emergence as a leader in the cloud computing service.

Matt’s leadership style involves listening to customers and fostering innovation, something I believe will be essential for AWS’s continued growth and adaptation in the rapidly growing cloud and AI sectors. Based on this background, he blends technical expertise, customer-centric focus, and strategic leadership which will likely steer AWS towards new horizons.

Diversity and AI Investment: Hedging Against Fierce Competition in Cloud Computing

While Amazon is facing fierce competition in cloud computing, the company has diversified to other growth segments as it still repositions in the cloud business through the new leadership. One of the major areas of diversity that is performing excellently is the advertising segment. The business segment has emerged as a powerful driver of growth and a noteworthy source of revenue. The company’s advertising revenue for the fiscal year 2023 was $46.9 billion, up more than 24% from the previous year. Its ad income increased from $12.63 billion in 2019 to $46.9 billion in 2023 – nearly a four-fold increase – indicating an interesting upward tendency. This is exceptionally phenomenal!

Statista

Amazon is maintaining its solid growth trajectory in this segment even in this year as shown by a 24% ads revenue growth in Q1 2024 to reach $11.8 billion. The spike is a result of Amazon’s deliberate extension of its advertising platform, which includes the launch of Prime Video advertisements. In addition to diversifying Amazon’s revenue sources, the decision to commercialize its expansive platform has given advertising access to a sizable and active audience.

Through its diversity, equity, and inclusion [DEI] approach which they have integrated in their marketing and advertising, AMZN aims at resonating with a broader audience which in turn can foster a deep connection with their customer base and thus, a sustainable revenue generation from the ads business.

Through these deliberate and well-thought-out strategies, I am confident that Amazon will sustain its ad revenue growth in the long run. The company is estimated to hit ad revenue of $70.8 billion by 2027 marking a growth of 60% which, I believe, is feasible given its strategic approach in this business line. It is even more attractive that the projected growth rate by 2027 is higher than its competitors, with Google Ads revenue estimated to grow by 35% and META projected to grow by 7%. In my view, this shows that AMZN has a new powerful growth catalyst in its ads business segment which compliments AWS.

With Amazon realigning its AWS business through new leadership and the deliberate efforts made in the advertising segment, the company is also investing in AI to give these two major growth catalysts a new dimension. For instance, it has completed a $4 billion investment in Anthropic to advance generative AI. The investment is aimed at enhancing AWS capabilities in several ways. For example, it is expected to introduce the Claude 3 family of models on AWS, which are advanced AI models with near-human levels of responsiveness and advanced intelligence. In the digital advertising revolution, the impact of generative AI can’t be overlooked because it has a tremendous positive impact. For example, generative AI has automated ad buying, making it more efficient and cost-effective. Ads are optimized in real-time based on audience data, ensuring that they reach the appropriate individuals at the right times. In a nutshell, Amazon’s AI investment is expected to greatly improve AWS, making it a more powerful platform, while generative AI breakthroughs will alter digital advertising by making it more efficient and cost-effective.

My Thoughts On The AWS and Diversity

Although what has been Amazon’s growth lever appears to be facing intensifying competition and sales could be bottoming, the new leadership could be the game changer here, and I think sooner than later, the business segment could regain its potential, especially given the investment in generative AI. Further, AMZN has diversified its revenue generation, and it appears to have found another growth center in the ads business segment. The strategies implemented, current performance, and outlook make it a dependable growth machine as Matt guides AWS in a new direction where I believe Amazon will see stronger growth than before. Given this background, I think the long-term outlook is bright, which aligns with my optimistic price target under the technical analysis.

The Wrap Up

In conclusion, I am bullish in the long term, guided by the diversity and the change in AWS management. However, the technical analysis points out a neutral short-term outlook which leads me to hold the recommendation until we can see a clear break out above the current resistance zone, which will mark a good entry point to a new upward rally which would be the road to the $285.16 price target.

Read the full article here