G-III Apparel Group (NASDAQ:GIII) is a fashion brand conglomerate. The company owns brands like Karl Lagerfeld, DKNY, Donna Karan, and Vilebrequin. It also licenses brands like Calvin Klein and Tommy Hilfiger.

This article analyses the company’s 1Q25 results and earnings call. The company did not meet consensus revenues and posted a flat top line. This may have led to the 15% stock price decrease after the release. However, under the hood, the results were very good for the company’s proprietary brands, with revenues growing by 16% YoY. On the bottom line, the company met expectations and maintained margins despite the headwinds in the licensed business. The margins dynamic is a positive signal when forecasting the business margins after losing the CK and TH licenses. G-III also announced an equity investment in a brand manager and wholesaler focusing on the Iberian Peninsula and India.

I started covering G-III in March 2024 with a Buy rating. My rating was based on the company’s good, long-standing, and equity-invested management, low leverage, and the potential of the company’s brands. Despite the significant uncertainty respecting the margins of the company’s proprietary brands, the stock price implied relatively low margins are needed to obtain an adequate return. As we will discuss, the company’s fundamentals have improved, whereas its price has been flat. For that reason, I maintain my Buy rating on G-III.

Good results under the hood

G-III’s 1Q25 results headline was not good. The company missed consensus revenues by about 1% and posted flat sales. The stock is down 15% since the earnings release. I find the reaction exaggerated, given that if we dive into the details, there are plenty of reasons to be happy about G-III’s results.

First, we need to separate the results for the company’s two segments (licensed and proprietary brands), as presented in the quarter’s 10-Q.

The company’s licensed segment sales fell 13%. This was expected as the company’s leading licensed brands (CK and TH) did not perform well in the quarter, as reported by its owner, PVH Corp. (PVH). Readers should remember that G-III will lose the licenses representing most of this business in late calendar 2025.

On the other hand, the company’s proprietary brands (which will make up most of the business after the licenses are lost) grew by 16.7% in the quarter. This is a great figure. Furthermore, the brands grew in wholesale, a very challenging channel in the US. Most apparel brands reporting in the past few weeks have shown weakness in the US wholesale channel.

The profit results are also encouraging. Gross margins increased 130 basis points, as the proprietary brands carried higher gross margins and gained weight during the quarter. Inventories are down a healthy 22% despite flat sales.

Operating margins were flat, falling 30 basis points (from 2.5% a year ago to 2.2% this year). Margins fell because SG&A grew $10 million compared to one year ago (the company says this comes from marketing investments, specially from relaunching the Donna Karan collection).

Despite the slight margin decrease, I see these results as encouraging. The company’s licensed brands’ weight in revenues fell by seven percentage points (from about 51% a year ago to 44% in 1Q25), but margins were almost flat. This indicates that the profitability of the proprietary brands is not meaningfully different from that of the licensed brands.

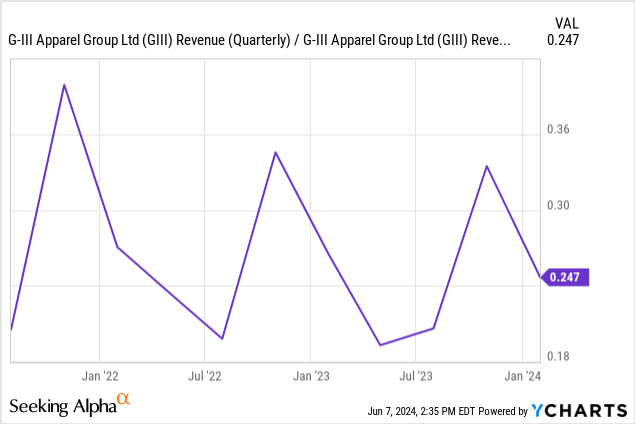

Finally, the low margin for the quarter (vis-a-vis a 9.5% operating margin TTM) is to be expected, given that Q1 is a low-seasonal quarter for G-III. Most of the company’s sales (60 to 65%) happen during the year’s second half, as seen below and as commented on the company’s 10-K (under seasonality). Despite the quarter’s lack of relative importance, I believe the trends seen are positive.

Brand developments

The company commented on brand developments in its proprietary brands. The most important thing, that has already been analyzed, is the tremendous top-line growth. This was driven by gaining access to wholesale accounts and shelf space on old accounts (for example, by expanding product categories).

Starting with Karl Lagerfeld, the brand launched a suit and a jeans collection, two categories in which it had not previously participated. It also found partners to expand the brand’s leisure business (hotels and villas) in Dubai and Portugal. Management also announced that the streaming service Hulu launched a miniseries based on the life of Karl Lagerfeld. A movie about the designer is being evaluated, too. All of this talks about the brand equity behind the name. Vilebrequin is also winning in the licensing game, with plans to open fifteen partner-operated beach clubs under the brand’s name in luxury vacation locations.

DKNY launched its fall collection starring Kaia Gerberg (10 million Instagram followers). The campaign is based on ‘The Heart of New York,’ playing with the famous city motto ‘I (heart) New York.’

After revamping the brand and products, Donna Karan made its new debut. The launch campaign featured several legacy actresses, including Cindy Crawford, Linda Evangelista, Carolyn Murphy, Amber Valletta, and Karlie Kloss. The brand is still a small part of G-III’s portfolio, but management is confident it will show substantial growth during the Spring 2025 campaign (to be sold during the second half of this fiscal year).

Finally, G-III announced a $54 million investment in brand manager AWWG Group for a 12% equity stake. AWWG manages three proprietary brands in the aspirational lifestyle space (Pepe Jeans London, Hackett, and Faconabble). The company is also a strong distributor for PVH on the Iberian peninsula and in India. According to management during the call, AWWG generated revenues of $650 million last year. G-III expects that AWWG will help its proprietary brands grow in Europe. Management commented during the call that it is expected to increase its equity stake in AWWG to 20% during the year and potentially more in the future.

Valuation is more attractive

G-III has a market cap of $1.22 billion, which, adjusted for cash and debt, results in an EV of $1.15 billion, basically flat from one quarter ago. However, the company’s fundamentals have improved significantly, so I think the stock is still a Buy.

G-III guided revenues of $3.2 billion for the year, representing conservative growth of about 3.5%. Inside the hood, this is divided between its proprietary brands, which grow to 70% of sales, whereas the licenses decrease.

If we ignore the licensed business altogether, G-III guidance implies revenues of $2.24 billion for FY25 from its proprietary brands. The problem is that we do not know the operating margins of these brands.

What margin would be necessary to generate an EV/NOPAT multiple of 10x on the EV of $1.15 billion? With an NOPAT of $115 million and an effective tax rate of 30%, we arrive at an operating income of $164 million. In turn, this represents an operating margin of 7.3% on revenues of $2.24 billion.

I believe a margin of 7.3% on the proprietary brands is very doable. First of all, the company currently generates an operating margin TTM of 9.4%. Last year, the proprietary brands generated 45% of sales, so their margin cannot be meaningfully different from 9.4%, otherwise the aggregate margins would be lower. Further, as commented above, for 1Q25, the proprietary brands gained 7 percentage points in revenue compared to licensed brands, and yet operating margins did not fall. This also signals that the company’s proprietary brands are not much less profitable than the licensed brands.

Therefore, even if the proprietary brands were two percentage points less profitable than the company’s average, we would still make a 10% earnings yield on the EV of G-III, based on the proprietary brand business alone.

In addition, the licensed business comes for free. We can subtract the value of the licensed business (which will last for this fiscal year and the next) from the company’s EV. This would mean either a lower required margin for the proprietary brand business or a lower multiple (higher yield) at the same margin. In my previous article, I considered the licensed business to represent about $170 million in profits going forward. At 7.3% margins, this would decrease the EV/NOPAT multiple on the proprietary business to 8.5x.

These multiples, or conversely the margin required on the proprietary business, provide an attractive opportunity, considering the quality characteristics of G-III. The company has been a big player in its main markets (lifestyle aspirational outerwear) for several decades. Its proprietary brands have good brand equity, as shown by their licensing to the leisure and film industries and their recent growth in a challenging context. The company is not very leveraged, with cash in excess of debt. Its management has an 11% stake in the company (FY24 proxy).

Therefore, I continue to consider G-III a Buy after the 1Q25 results.

Read the full article here