My goal is to track the 500 world’s best companies, and we use a few lists as a proxy.

- Every dividend aristocrat and champion, including foreign ones (25-plus year dividend growth streaks).

- Top 100 holdings in VIG (aristocrat and future aristocrat ETF).

- Top 100 holdings in SCHD (gold standard high-yield blue-chip ETF).

- Top 100 holdings in IWY (gold standard growth ETF).

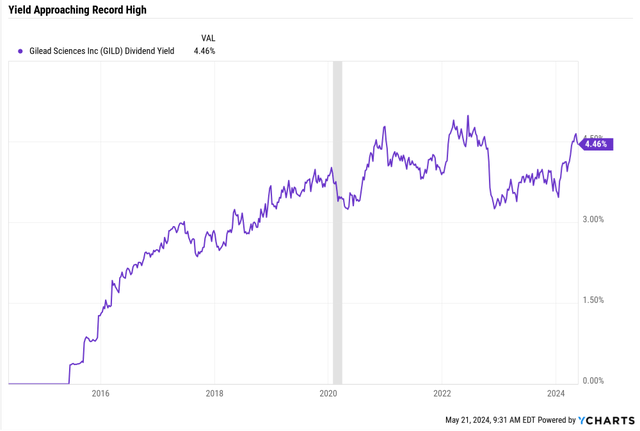

A recent addition is Gilead Sciences (NASDAQ:GILD), which many people have asked me about recently, as the yield has risen to an impressive 4.6% and the company hits another 52-week low.

YCharts

Of course, no company is right for everyone, so first, let’s examine whether GILD’s 4.6% yield is something you can safely consider today. But let me show you why I, as a GILD shareholder, am not willing to buy more or recommend a purchase right now.

Gilead Sciences: 15 Years In The Growth Wilderness

FactSet Research Terminal

Gilead’s record sales were in 2015, and so was its net income, a blockbuster $19 billion profit, representing 59% net margins.

Since then, the company has struggled and even suffered a more than 50% decline in profits.

What on earth happened?

The Downside Of Blockbuster Success In Big Pharma

Gilead’s sales soared from $10 billion in 2012 to $33 billion in 2015. That’s more than 200% sales growth, or 50% annualized over three years. What miracle conjured such blockbuster growth?

Sovaldi was approved by the FDA in 2013 and priced at $1,050 per pill, leading to a typical treatment cost of $84,000.

Harvoni followed it in 2014, which combined Sovaldi with ledipasvir, an NS5A inhibitor, increasing the effectiveness from 84% to 96% (cure rate) to 96% to 100%.

This was a single daily tablet, priced at $94,500 for a typical course of treatment.

This was indeed a miracle drug for those suffering from Hepatitis C. At least initially, it seemed to be one for GILD investors as well.

In the first quarter of 2014, Sovaldi alone generated $2.3 billion in sales, setting a record for first quarter sales of a new drug. In the first year, $10.3 billion in sales made Sovaldi one of the leading drugs on earth.

According to FactSet Research, in 2015, Harvoni achieved $14 billion in sales, rivaling AbbVie’s (ABBV) Humira for the world’s best-selling drug.

Cen.AS.org

While Hepatitis C is a chronic disease that leads to terrible liver damage and eventual death, these miracle drugs cured the disease, but they didn’t treat it.

This led to a rapid decline in sales, especially as biosimilars hit the market.

| Year | Harvoni Sales ($millions) | YOY Change |

| 2014 | $2,127 | NA |

| 2015 | $13,864 | 551.81% |

| 2016 | $9,081 | -34.50% |

| 2017 | $4,370 | -51.88% |

| 2018 | $1,222 | -72.04% |

| 2019 | $643 | -47.38% |

| 2020 | $272 | -57.70% |

| 2021 | $212 | -22.06% |

| 2022 | $115 | -45.75% |

| 2023 | $70 | -39.13% |

| 2024 | $56 | -20.00% |

| 2025 | $48 | -14.29% |

| 2026 | $47 | -2.08% |

| 2027 | $42 | -10.64% |

| 2028 | $44 | 4.76% |

| 2029 | $48 | 9.09% |

(Source: FactSet Research Terminal)

Gilead has struggled for years to find something to replace such incredible growth, and now it has.

HIV and Oncology: Gilead’s Path To Steady Growth

Gilead might have made headlines for its HCV drugs due to how fast those sales rose and then crashed.

But it was founded as a leader in HIV treatments. Gilead’s tenofovir, or TDF molecule—is the heart of its HIV franchise, which is $17 billion in sales, or 60% of company revenue.

This is a very established technology with low manufacturing costs and high margins.

And unlike Hep C, HIV is a chronic disease.

However, Gilead investors face the problem that while HIV is very steady and margin rich, it’s not a growth business.

But oncology is, as the world ages and more people develop cancers.

This is one of the most lucrative parts of the pharmaceutical industry because the treatments are complex biological compounds called immunotherapies rather than simpler chemicals.

Biosimilars take longer to get approved, and companies can charge truly remarkable prices.

The Most Expensive Cancer Drugs In The World

Danyelza (Y-mAbs Therapeutics, Developed by researchers at Memorial Sloan Kettering Cancer Center): Priced at $1,010,000, Danyelza treats neuroblastoma in bone or bone marrow.

Kimmtrak (Immunocore Holdings): At $975,520, Kimmtrak is an immunotherapy for UVLO melanoma.

Folotyn (Acrotech Biopharma): Costing $842,585, Folotyn treats peripheral T-cell lymphoma.

Blincyto (Amgen): Priced at $754,720, Blincyto is an immunotherapy for acute lymphoblastic leukemia.

Cyramza (Eli Lilly): With a monthly cost of $13,256 ($159,072), Cyramza treats stomach and non-small cell lung cancer.

Xofigo (Bayer): At $12,657 monthly ($151,884), Xofigo is used for late-stage prostate cancer.

In 2020, GILD made $27 billion in acquisitions focused on cancer drugs via companies like Kite Pharma. However, things haven’t gone as well as management had hoped.

In The Age Of GLP1 Mega Growth, Gilead’s Solid Growth Underwhelms

Gilead currently has two potent oncology drugs, Yescarta (Lymphoma) and Trodelvy (breast and bladder cancer).

FactSet Research Terminal

GILD has faced disappointing trial results, with analysts expecting its key oncology drugs to rise from $2.5 billion in revenue in 2023 to $5.4 billion in 2029.

That’s solid growth, but it’s nothing compared to the blockbusters Merck (MRK) is enjoying with Keytruda ($33 billion in peak sales in 2027 and 2028).

$45 Billion In Anti-Obesity Drugs For Eli Lilly (LLY) Alone By 2029

FactSet Research Terminal

GLP 1 weight loss drugs have taken the pharmaceutical industry by storm. By 2030, Cowen estimates total sales will be $102 billion, with LLY accounting for almost 50%. Over the next 10 years, GLP1 drug sales could surpass $700 billion, rivaling $1 trillion spent on Statins since the first statin drugs were released in 1987.

YCharts

Moody estimates 6% long-term growth for the entire pharma industry, and cancer giants like Merck are expected to surpass that slightly (due to patent cliffs).

Gilead’s FactSet consensus has fallen to 6.1% in recent weeks as its disappointing trial results and increased competition are weighing on its growth outlook.

GILD’s big bets on growth, new kinds of HIV treatments (longer acting), and oncology appear to be working... sort of.

Yes, 6% growth from 2025 through 2029 is much better than the negative growth investors have endured for a decade.

However, compared to companies like LLY or Novartis (NVS), leaders in GLPs1s? Investors have shown no interest in GILD’s steadily higher-yielding shares.

YCharts

Including dividends, which have risen for a decade at 9% annually, though dividend growth has slowed to 3% this year, investors who bought at the peak are still down 25%.

FAST Graphs

Note that GILD was never trading above 12X earnings at the peak; it’s just that earnings collapsed, and so investors have suffered.

That’s why stocks are “risk assets,” and no stock is a “bond alternative.”

The Good News For Gilead Investors

After one final terrible year, GILD is expected to return to modest growth, matching the pharma industry’s 6%.

FactSet Research Terminal

The dividend is expected to grow at 4% annually, keeping the payout ratio under the 60% safety guideline rating agencies like to see for most industries, including big pharma.

FactSet Research Terminal

The balance sheet is strong, with leverage reducing to sub-two. This, combined with a better growth outlook, has the S&P upgrading GILD to BBB+ with a positive outlook in 2023.

Rating agencies consider most industries, including big pharma, safe when they have 3X or less net debt/EBITDA.

FactSet Research Terminal

A positive outlook means by 2025, there’s a 33% chance that GILD will get upgraded to A-. That represents a 50% reduction in 30-year bankruptcy risk, down from 5% today to 2.5%.

The bond market, via credit default swaps, is pricing 30-year default risk at 2.4%, already consistent with an A- credit rating.

S&P

FactSet Research Terminal

The bond market is the “smart money” focused purely on fundamental risk. Bond investors are confident that GILD’s turnaround will succeed, with 30-year bonds trading at the same interest rates as when they were issued last year.

If bond investors were worried about GILD, you’d see yields on the longest-duration bonds rising and credit default swaps rising. Instead, they have been falling in the last three months.

The Dividend Is Very Low Risk

| Rating | Dividend Kings Safety Score (1,100 Metric Model) | Approximate Dividend Cut Risk (Average Recession) | Approximate Dividend Cut Risk In Pandemic Level Recession |

| 1 – unsafe | 0% to 20% | over 4% | 16+% |

| 2- below average | 21% to 40% | over 2% | 8% to 16% |

| 3 – average | 41% to 60% | 2% | 4% to 8% |

| 4 – safe | 61% to 80% | 1% | 2% to 4% |

| 5- very safe | 81% to 100% | 0.5% | 1% to 2% |

| GILD | 94% | 0.5% | 2.00% |

| S&P Risk Rating | Exceptional 88% Optimal | BBB+ Positive outlook credit rating = 5% 30-year bankruptcy risk | 20% or Less Max Risk Cap |

GILD’s 4.6% yield is very low risk, based on our 1,100 metric model that includes debt metrics, payout ratios, dividend track records, short-term bankruptcy risk, accounting fraud risk, credit ratings, and long-term risk ratings from S&P.

Factoring in historical profitability and moatiness, GILD scores 89% Ultra Sleep Well At Night or Ultra SWAN.

That’s very high quality, on par with wide-moat aristocrats.

S&P

S&P reports risk management by comparing each company’s rating against the industry’s No. 1 name for that particular risk metric.

The final score now represents the % optimal risk management based on every fundamental risk to the business.

GILD scores 88% in optimal risk management, which is exceptional.

| S&P LT Risk Management Score | Rating |

| 0% to 9% | Very Poor |

| 10% to 19% | Poor |

| 20% to 29% | Suboptimal |

| 30% to 59% | Acceptable |

| 60% to 69% | Good |

| 70% to 79% | Very Good |

| 80+% GILD 88% | Exceptional |

FactSet Research Terminal

The valuation appears low but remember that GILD has been cheap for a reason for a decade.

If the price remained flat through 2029, the yield would rise to 5.5% if the dividend grew as expected.

That’s identical to Bristol-Myers’ (BMY) current yield of 5.5%. In other words, if GILD stumbles even a little, its price might stagnate for several years, resulting in disappointing returns.

The Bad News for GILD Investors

GILD’s growth potential is better than it was before. But that’s damning with faint praise.

4.6% yield + 6% growth = 10% to 11% long-term return potential, similar to Schwab’s U.S. Dividend Equity (SCHD) ETF.

However, with SCHD, you get a 4% yield with 100 companies providing income streams compared to just one company.

Dividend Kings Zen Research Terminal

$71.52 is the historical fair value right now, a 6% discount, making GILD a potentially good buy if you like the company’s fundamentals and 10% to 11% long-term return potential.

FAST Graphs, FactSet

In the short term, GILD doesn’t appear to offer much upside.

FAST Graphs, FactSet

Over the next five years, the consensus total return potential will also disappoint, at about 8%.

Bottom Line: Gilead Has Growth Shoots, But The 4.6% Yield Isn’t Enough To Recommend It

GILD longs have had the patience of saints. But after a decade of negative growth, finally, there’s hope in the form of new HIV drugs and a stronger oncology pipeline.

However, GILD’s cancer franchise isn’t industry-leading by any means, and its growth prospects have drifted lower to 6%, the industry average.

While the 4.6% yield is very low risk, dividends are only expected to grow 4% through 2029, and 10% to 11% long-term return potential is no better than what SCHD or VYM offer.

I own $2K worth of GILD via ETF.

I would recommend GILD only to index fund investors and advise anyone considering buying it to consider superior alternatives, of which there are many.

Remember that every individual stock you own represents a real risk of a fundamental capital loss.

Wide Moat Research

Most individual companies don’t do well. Many suffer what JPMorgan calls “permanent catastrophic declines.”

Any time you buy an individual stock, you risk such a decline. As we advance, you are responsible for carefully monitoring that company to ensure you aren’t left holding the bag if the wheels fall off the bus.

Before buying any stock, ask yourself if the potential total return is worth the risk of owning something that, like GILD itself, has been in a bear market for almost a decade.

Is a long-term return of 10% to 11% worth the complex risk profile of any company, especially in the pharmaceutical industry? Or is it better to consider higher-yielding, more undervalued blue-chip stocks of equal or higher quality that grow faster and offer superior return potential and income growth?

Hedges = 50% long bonds and 50% managed futures (Portfolio Visualizer)

Read the full article here